All Special Report articles – Page 13

-

Special Report

Special ReportTop 1000 Pension Funds 2022: Pension assets increase reflects 2021’s markets

The assets of the leading 1000 European pension funds increased by well over €600bn in our latest survey – a large portion of which can be attributed to strong investment returns on the back of a sustained post-COVID rebound over the course of 2021. Developed market equities returned over 30% in euro terms in 2021, compared with losses of around 4.7% in global aggregate bonds.

-

Special Report

Top 1000 Pension Funds 2022: Data

OECD Pension Funds in Figures, 2022 (data for France from 2021 edition); *Data on asset allocation in these figures include both direct investment in equities, bills and bonds, cash and deposits and indirect investment through CIS when the look-through of CIS investments is ...

-

Special Report

Special ReportAccess the data behind Top 500 Asset Managers 2022

Covering over €100 trillion of managed assets and 500 global firms, IPE’s annual asset management study offers vital market data and intelligence for those in and around the institutional investment industry. Whether you are looking for data on competitors, clients or prospects in the asset management sector, our full 2022 ...

-

Special Report

Special ReportSpecial Report – Outlook

It’s hardly news that inflation is high on asset owners’ minds right now. We asked eight seasoned asset allocators, CIOs and strategists the same question: how do you rate the chances of stagflation? And what to do about it?

-

Special Report

Special ReportOutlook: The search for safe havens

Are we heading for stagflation and how should institutional investors prepare?

-

Special Report

Special ReportOutlook: Investors grapple with inflation and rising rates

The asset allocation options available to institutional investors in such uncertain times are few

-

Special Report

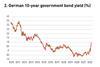

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

Special Report

Special ReportOutlook: Future of hydrocarbons

The OECD remains critically dependent on Russian oil and gas – and finding alternative sources will be very hard

-

Special Report

Special ReportFour challenges for asset managers

Leading figures respond to key questions on ● Investment strategy ● ESG

-

Special Report

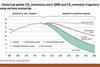

Outlook: Can investors act alone on energy policy?

It may be up to governments to set the rules of engagement to achieve net zero

-

Special Report

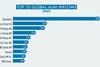

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.

-

-

-

Special Report

Special ReportTop 120 European Institutional Managers 2022

Total non-group assets managed for all types of European institutional clients – pension funds, insurance companies, corporates, charities and foundations – for the leading 120 managers in this business segment. Total assets are €14.4trn (2021: €12.2trn)

-

Special Report

Special ReportTowards a sustainable portfolio theory

Applying monetary values to impacts would allow investors to direct capital better and assess opportunities for improved long-term returns

-

Special Report

Special ReportStrategy: The search for integrity and effectiveness

Investors are increasingly seeking real-world impact, but understanding of what that means and how it can best be achieved is still evolving.

-

Special Report

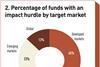

Special ReportData: focus on impact hurdles

An increasing number of impact funds link carried interest to impact goals. Asset owners can help by encouraging this trend

-

Special Report

Special ReportConsigning fossil fuels to the past

How are asset managers supporting the shift away from fossil fuels in energy intensive sectors?

-

Special Report

Special ReportCorporate lobbying comes under the spotlight

Companies are starting to respond to investors’ demands for transparent and consistent lobbying.