All Special Report articles – Page 14

-

Special Report

UK Stewardship Code: a platform for impact

Investors and specialist managers could use the UK’s revised Stewardship Code to showcase intentionality and impact

-

Special Report

Special ReportDriving change as the debate on impact evolves

It’s hard to believe, but this is IPE’s fifth annual special report dedicated to investing for impact: our first impact investing report was in 2018. What has changed since then? In some ways not much. We still have a debate about the credibility of claiming impact in public markets, where the narrative is all about stewardship in the form of engagement and voting, and we discuss the effectiveness of engagement versus divestment.

-

Special Report

Special ReportManager selection: Market trends

Manager selection consultants are helping investors navigate the next stages of ESG integration

-

Special Report

Special ReportSpecial Report – Manager selection

With COVID-19 now under control, the business of selecting managers no longer has to deal with severe restrictions on travel and face-to-face interactions. However, the pandemic has taught investors and manager selection advisers some important lessons.

-

Special Report

Special ReportManager selection: Asset management operations under scrutiny

The role of outsourced operational due diligence on asset managers is becoming more prominent

-

Special Report

Special ReportSpecial Report - Regulation

Europe’s flagship SFDR regime for ESG was never intended to become a fund-labelling framework. So as Susanna Rust also writes in this issue, it is a relief that the EU is now consulting on minimum requirements for Article 8 funds. In this Special Report, we look in some depth at how asset managers have embraced SFDR, taking in the broad reclassification exercise that has taken place to relabel existing funds, and the short-term risks of greenwashing. In the longer term, the hope is for much more standardisation and there are signs that this is already happening.

-

Special Report

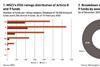

Special ReportRegulation: SFDR put to the test

One year in and the verdict on the EU’s Sustainable Finance Disclosure Regulation (SFDR) is mixed

-

Special Report

Special ReportPensions regulation in Switzerland

Developments in the pensions landscape in Switzerland

-

Special Report

Special ReportPensions regulation in the UK

Developments in the pensions landscape in the United Kingdom

-

-

Special Report

Special ReportPensions regulation in The Netherlands

Developments in the pensions landscape in The Netherlands

-

-

Special Report

Special ReportMiFID II: A threat to European sustainability?

MiFID II is unintentionally jeopardising the long-term objectives of ESG investors

-

-

Special Report

Special ReportCSDR’s settlement penalties kick in

New regulations attempt to clarify and standardise securities settlement procedures

-

Special Report

Special ReportSpecial Report – Pan-European Personal Pensions

From March, the European Commission’s vision of a simple, cross-border savings product becomes a reality with the launch of the Pan-European Personal Pension Product (PEPP). EU citizens will for the first time be able to channel savings into a long-term third-pillar product that is cost effective, simple and portable across borders.

-

Special Report

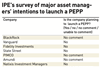

Special ReportThe jury is still out on PEPP: industry views

IPE asked some of the leading voices in the European pension industry to comment on the likelihood of success for the PEPP

-

Special Report

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

-

Special Report

Special ReportCase study: Readying PEPP for launch

The EU’s PEPP is like a shuttle aircraft, with the potential to carry individual savers across Europe. But its flight plan is detailed and complex, and admin providers play a key role in preparing PEPP for launch

-

Special Report

Special ReportFrancesco Briganti: All’s well that ends well for PEPP?

Despite the remaining questions, the impact of the PEPP on European pensions could be positive