All IPE articles in July/August 2019 (magazine)

View all stories from this issue.

-

Special Report

Special ReportHave we passed peak regulation?

Securities insiders believe the tide of regulation is finally ebbing

-

Opinion Pieces

Opinion PiecesLetter from the US: On a secure retirement path

The most significant changes to US retirement plans in more than a decade look set to be approved by Congress. On 23 May, the House of Representatives passed the Secure Act – Setting Every Community Up for Retirement Enhancement – by 417-3, and the Senate is also likely to approve it, with President Donald Trump unopposed.

-

Features

FeaturesRelative response to liquidity issues

Equity risk is a crucial portfolio exposure for pension funds and a key driver for long-term retirement outcomes for pension plans and their beneficiaries. Yet the structure of equity markets is in transition, which changes the way pension funds choose to allocate capital to them.

-

Asset Class Reports

Asset Class ReportsTrade war minefield for investors

High-quality companies are most likely to withstand the ravages of a prolonged US-China trade war

-

Features

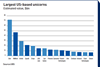

FeaturesIPOs: Unicorn hunting

“Public interest in IPOs hasn’t been this high since the dot-com era of the late 1990s,” say analysts at UBS. Such popularity is stoking fears of a bubble in unicorns – privately-financed start-ups valued at over $1bn (€900m) taking listings.

-

Features

FeaturesItaly’s first-pillar obsession

Italy’s anti-establishment, eurosceptic coalition government has partly delivered on its promise to reform the pension system. ‘Dismantling’ the 2011 pension reform that curtailed benefits and raised the retirement age was key for both coalition partners – the Five Star Movement and the Lega. Previous governments had raised the retirement age.

-

Features

FeaturesESG: Greenwashing under scrutiny

The term ‘greenwashing’ was reportedly coined by US environmentalist Jay Westerveld in 1986 in an essay about hotels’ practice of putting up notices in hotel rooms to encourage guests to reuse towels. He accused them of making false claims about being environmentally responsible since they only adopted such practices when they reduced costs.

-

Country Report

Country ReportESG picks up steam

Italian pension funds have been late starters in embracing ESG principles but they are catching up fast

-

Country Report

Country ReportPrivate equity: Visions of the future

Is Project Iris, a joint effort by Italian pension funds to invest in alternatives, a sign of things to come?

-

Asset Class Reports

Asset Class ReportsUS equities: Past, present and future

Are US equity valuations in bubble territory?

-

Interviews

InterviewsHow we run our money: Eni

Carlo di Gennaro, head of global group pensions at Eni, tells Carlo Svaluto Moreolo how the oil and gas company is streamlining its pension strategy

-

Features

FeaturesThe Disneyworld trap

The remarkable reversal in the outlook for official interest rates over the past few months has received relatively little attention. Until recently it was widely accepted that rates could only move upwards. It looked almost certain that quantitative tightening (QT) would supplant quantitative easing (QE). Now the balance has reverted to further monetary accommodation.

-

Asset Class Reports

Asset Class ReportsPowerful currents transforming energy

Rapidly improving renewable energy technologies and global warming concerns are fuelling radical changes in the US energy sector

-

Country Report

Country ReportCOVIP: The glass is half full

Despite its several ailments, the health of the Italian pension industry keeps improving

-

Special Report

Liability Strategies - Consolidator funds: New tools, new models

Can consolidator funds provide an additional tool for UK pension schemes approaching the defined benefit endgame?

-

Special Report

Special ReportCommentary: The endgame

UK pension funds should consider nine dimensions as they move to deris

-

Interviews

InterviewsStrategically speaking: Muzinich & Co

We are living in Disneyworld,” says George Muzinich, the CEO and chairman of Muzinich & Co, a New York-based investment manager specialising in corporate credit.

-

Features

FeaturesEC’s expert group releases landmark climate taxonomy

The European Commission’s expert group on sustainable finance last month published its long-awaited final recommendations for a taxonomy of environmentally sustainable activities, which is at the heart of the EU executive’s plan to harness the finance sector for its fight against climate change.

-

Interviews

On the record: China

We asked two pension funds to tell us about the case for investing in China and their experience with investing in the country

-

Special Report

Special ReportCDI takes root

Matching and cashflow strategies are gaining ground around continental Europe, sometimes with a green tinge