All IPE articles in October 2019 (Magazine)

View all stories from this issue.

-

Opinion Pieces

Opinion PiecesTime to talk pensions

At a press briefing last month, Bill Galvin, chief executive of the UK’s £68bn (€77bn) Universities Superannuation Scheme (USS), emphasised the importance of improving its communication policy.

-

Special Report

Special ReportManagement & outsourcing: The rush is on

Competition is intensifying among providers of data analysis and benchmarking solutions

-

Interviews

InterviewsOn the Record: Lower yields

After the ECB’s announcement of more QE, we asked two pension funds how they plan to manage the prospect of lower yields

-

Interviews

InterviewsHow we run our money: ZVK

Gregor Asshoff (pictured), board member of ZVK, the pension fund for Germany’s construction workers, talks to Carlo Svaluto Moreolo about upcoming asset allocation shifts

-

Country Report

Country ReportSystem reform: A hot political plot

Pension reforms have reached a second stage as President Macron seeks to push through radical changes

-

Opinion Pieces

Opinion PiecesStoring up future pain

Anyone who back in 2008 had accurately predicted what monetary policy would look like today would certainly have been regarded as unhinged.

-

Features

FeaturesGovernment Pension Investment Fund: Widening the reach

The president of Japan’s €1.3trn Government Pension Investment Fund (GPIF) reflects on the challenges of century-long stewardship

-

Country Report

Country ReportPension regimes: The second pillar evolves

The second-pillar pension regime for private sector employees, AGIRC-ARRCO, is entering a new phase of its development

-

Features

FeaturesEverything is still possible

Markets are on edge as a result of difficult economic and geopolitical forces. Risks are still skewed to the downside. Trade tensions have not abated, rather there is a possibility of further escalation in the future, which looks like reducing investment, and damaging already apprehensive outlooks.

-

Asset Class Reports

Asset Class ReportsSmall & mid-cap equities: Public or private markets?

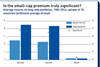

Public markets are shrinking while private markets are attracting huge amounts of capital. But it is still not clear which is the better bet

-

Asset Class Reports

Asset Class ReportsThe small-cap conundrum

Academic studies have cast doubt on the existence of a premium for investing in small-cap stocks

-

Opinion Pieces

Opinion PiecesPensions in a hostile climate

Outside the realm of US public pension plans, where generous return assumptions and inflated discount rates are common, the medium and long-term outlook for asset classes is of serious importance to most pension funds.

-

Country Report

Country ReportFrance: PACTE changes the landscape

The new PACTE law will transform pension saving in France

-

Features

FeaturesBriefing: Draghi’s parting gift on ECB stance

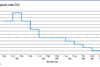

If anyone in Europe was left in any doubt on 11 September about the dovishness of the European Central Bank (ECB) under Mario Draghi’s leadership, by close of business on the next day their doubts were surely dispelled. On that day the outgoing president of the ECB unleashed a bout of monetary easing, in an attempt to boost euro-zone inflation from 1% to its target of “below, but close to, 2% over the medium term”.

-

Features

FeaturesBriefing: US makes rapid turnaround

Father Christmas delivered a sack of coal to equity markets last Christmas Eve, with the S&P 500 index losing 1.8%, following a three-day slide. Forecasters had previously been expecting two or three rate hikes in December, as Federal Reserve chairman Jerome Powell steered that discussion. He had mistakenly assumed that the economy had not yet reached a normal, neutral level but it already had, forcing him to backtrack.

-

Features

FeaturesBriefing: Deep tensions threaten EU vision

This is not a commentary on the UK within or without Europe. Brexit has been a compelling distraction but it is one macroeconomic strand in a complex world. The overwhelming coverage has also moved attention away from key internal tensions within the European project.

-

Features

FeaturesBriefing: Coping with lower for much longer

German institutional investors have shifted their asset allocation due to low bond yields

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Jennifer Choi & Brian Hoehn

“Principles 3.0 is intended to offer a road map to optimal partnerships in the private equity industry”

-

Opinion Pieces

Opinion PiecesLetter from The US: How boards can hurt pension plans

US state and local pension funds manage over $4trn (€3.6trn) in retirement assets for 20m active and retired plan members. But most of the funds are in bad financial shape.

-

Opinion Pieces

Opinion PiecesDo not let costs become an obsession

Our report this month on management and outsourcing discusses how pension funds must increasingly rely on external organisations to analyse their portfolios, particularly from a cost perspective.