All IPE articles in November 2019 (Magazine)

View all stories from this issue.

-

Country Report

Country ReportSpain: The tide turns

Investors hope that this month’s general election brings much needed stability to a faltering economy

-

Opinion Pieces

Opinion PiecesWhat's in a pensions minister?

Last month, Jerry Moriarty, the chief executive of the Irish Association of Pension Funds, called on the country’s government to appoint a pensions minister

-

Features

Switzerland: Online lending

The popularity of crowdlending is rising, but will it challenge the mainstream?

-

Special Report

Special ReportRisk metrics jigsaw

Moves to promote useful climate risk disclosure among companies are hampered by highly variable risk metrics and a lack of cohesive standards

-

Special Report

Special ReportInvestment Research: The small-cap research squeeze

MiFID II is affecting smaller company research in unexcepted ways

-

Special Report

Special ReportIndustry viewpoints: Research post-MiFID II

How has research consumption changed since the unbundling of sell-side research costs from brokerage fees?

-

Special Report

Special ReportIceland: From strategy to practice

Several factors are pushing Icelandic pension funds towards responsible investment

-

Country Report

Country ReportPortugal: In search of higher yield

Asset allocation strategies remain largely unchanged and the search for yield broadens out

-

Opinion Pieces

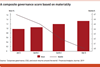

Opinion PiecesGuest viewpoint: Kerrin Rosenberg

“It is crucial to remember that the focus on good governance extends to including illiquid and private investment”

-

Interviews

InterviewsStrategically speaking: Generali Investments

A year into Generali’s ambitious growth plan, it looks set to meet its promises

-

Opinion Pieces

Opinion PiecesViewpoint: Spatial finance has a key role

The increasing amount of geospatial data can help foster sustainable finance

-

Opinion Pieces

Opinion PiecesViewpoint: The quagmire of ethics

Assessing what should be considered ethical is more challenging than generally assumed

-

Opinion Pieces

Opinion PiecesLong Term Matters: Time to shit or get off the (ESG) pot

The ESG project is well beyond its childhood, even its teenage years. PRI has been going for 13 years and SRI activity pre-dated it by a decade.

-

Special Report

Special ReportMateriality: A new framework for ESG

A new materiality concept focuses on seeking investment value where the interests of shareholders and other stakeholders intersect

-

Special Report

Mining the ESG vein

ESG used to be an optional extra in the mining industry but governments are starting to mandate minimum standards through legislation

-

Country Report

Country ReportDiscount rates: Stranger things

Negative interest rates are making Swiss pension funds more expensive

-

-

Asset Class Reports

Asset Class ReportsEmerging market debt – Global view: A mixed picture

Although emerging markets are in aggregate enjoying structural improvements, there are stark differences between regions

-

Opinion Pieces

Opinion PiecesSystemic risk debate intensifies

The financial system is facing its greatest challenge since the 2018 financial crisis

-

Features

FeaturesPerspective: Fear the walking dead

Zombie firms – those dependent on the easy availability of cheap credit – threaten to suck the life out of otherwise viable companies