All IPE articles in July/August 2020 (Magazine)

View all stories from this issue.

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.

-

Features

FeaturesPerspective: Trouble in Lykkeland

The decision to appoint Nicolai Tangen, a hedge fund owner, to the position of CEO at Norges Bank Investment Management has proved controversial

-

Features

FeaturesInvestment Strategy: Towards sustainable portfolio theory

This year marks the 30th anniversary of the 1990 Nobel prize in Economics given to Harry Markowitz, William Sharpe and Merton Miller. IPE is marking this in several ways. The first event took place at the IPE annual conference in Copenhagen in December 2019, with a panel discussion following on from the showing of a delightful video. The video was based on a few days that TOBAM CEO Yves Choueifaty and I spent with Markowitz in his office in San Diego in June of that year and showed Markowitz’s charm and humility despite his great achievements.

-

Country Report

Country ReportItaly: IORP II in limbo

The EU’s IORP II directive has yet to be fully implemented by Italian pension funds

-

Country Report

Country ReportItaly: Funds go private

Italy’s institutional investors have kept their focus on private markets during the COVID-19 crisis

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Rory Sullivan & Fiona Stewart

Better disclosure by asset owners is an important mechanism for driving sustainability in investment. But asset owners struggle with many aspects of sustainability reporting

-

Special Report

Special ReportInvestment services: Pandemic exposes voting tech flaws

Companies have been using online technologies to conduct their AGMs with varying degrees of success

-

Features

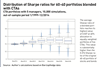

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

Features

FeaturesEU sustainability focus shifts

EU sustainable finance policy-making began with a vengeance in 2018, when the European Commission unveiled and embarked on its Action Plan for Financing Sustainable Growth. Two years later, the Commission is preparing to adopt a new, “more ambitious and comprehensive” sustainable finance strategy.

-

Interviews

InterviewsHow we run our money: ENPAB

Danilo Pone, CIO of ENPAB, the first-pillar scheme for Italian biologists, talks about the fund’s new proprietary asset allocation model

-

Country Report

Country ReportItaly's recovery: Endless opportunities for pension funds

Italian pension funds are primed to participate in Italy’s post-COVID-19 recovery

-

Opinion Pieces

Opinion PiecesLetter from US: Politics forcing divestment

American pension funds have become embroiled in the cold war between the US and China and diversification strategies may be affected by the new scrutiny of investments in Chinese companies.

-

Opinion Pieces

Opinion PiecesGrowing debt levels spell trouble

Credit investors would be wise to reflect upon the growing debt burden weighing on the global economy.

-

Features

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

Special Report

Special ReportInvestment services: CSDR's long and winding road

A new settlement regulation for central securities depositories has been delayed amid industry concerns and lack of clarity

-

Opinion Pieces

Opinion PiecesTurn crisis into opportunity

One of the most striking features of the discussion of what could be called the Corona crisis – the economic and financial crisis associated with the COVID-19 pandemic – is its pervasive intellectual laziness. Far too few commentators are trying to grapple with its unique features.

-

Special Report

Special ReportSWFs: Never waste a good crisis

Despite pressure on revenues from oil and gas, Arab sovereign wealth funds are taking opportunistic bets in foreign markets in the face of global economic turmoil

-

Asset Class Reports

Asset Class ReportsCredit: Investment grade credit markets in a pandemic

The COVID crisis has brought profound changes to the credit markets

-

Asset Class Reports

Asset Class ReportsCredit: High yield managers embrace uncertainty

Managers are constructive about high yield, loans and alternative credit despite the volatile outlook

-

Features

Research: The rise of climate investing in passive funds

COVID-19 is a devastating reminder of the fragility of life on Earth. It will be a key defining force of change in our age, alongside global warming.