All IPE articles in December 2021 (Magazine)

View all stories from this issue.

-

Interviews

InterviewsOn the record: Social issues

Three European pension funds discuss their increasing focus on social factors within their ESG-driven investment strategies

-

Features

FeaturesStrategically speaking: IFM Investors

When IFM Investors and its fellow consortium members cracked open the bubbly last month on their successful bid for Sydney Airport following a third revised offer, it marked a bet on a vigorous and sustained recovery in passenger aviation. After all, airports globally, including Sydney, had come to resemble “parking lots for planes”, in the words of IFM Investors CEO David Neal.

-

Country Report

Country ReportIceland leads the world on pensions

Nation’s retirement system rates high in pensions index for adequacy and sustainability, allowing it to pip the Netherlands and Denmark

-

Interviews

InterviewsHow we run our money: Oslo Pensjonsforsikring

Lars Haram (pictured), CIO of Oslo Pensjonsforsikring, tells Pirkko Juntunen about the fund’s evolving risk-management strategy

-

Country Report

Country ReportIceland: Pressure to relax limit on foreign investing

Pension funds look for flexibility to adjust their exposure to global opportunities

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Fiona Reynolds

Public and private sector leaders from around the world gathered in Glasgow for the United Nations Climate Change Conference (COP26) last month to tackle the climate crisis and kick off the next decade of climate policy.

-

Asset Class Reports

Asset Class ReportsTech: Uncertain future as FAANG stocks mature

Innovative tech giants deliver many societal benefits, but concerns over personal data misuse and market power abuse could elicit regulatory responses that inadvertently stifle innovation

-

Country Report

Country ReportInflation: Schemes keep wary eye on inflation

Few players anticipate rampant inflation rises, but pension funds are atuned to the actions of central banks around the world

-

Features

FeaturesPerspective: Sweden reshapes national ethical stewardship

The Swedish buffer funds are taking stock as the long-standing secretary general of the Council on Ethics steps down

-

Asset Class Reports

Asset Class ReportsThe end of social media as we know it?

Increased scrutiny of the power of Facebook, Twitter and Google to influence public opinion may force shareholders to make some uncomfortable decisions

-

Opinion Pieces

Opinion PiecesNotes from the Netherlands: Too eager to index

Most Dutch pensioners have been craving indexation ever since the financial crisis in 2008-09. Understandably, patience is running thin, especially now that inflation has reached its highest level since the introduction of the euro.

-

Special Report

Special ReportThe importance of defining inflation

Investors must reflect on the nature and components of the current rise in inflation

-

Special Report

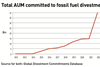

Special ReportEnergy: Are pension funds missing out in the rush to decarbonise?

As investors divest from fossil fuels, others are stepping in, and the result is not lower emissions from the hydrocarbon industry

-

Opinion Pieces

Opinion PiecesNo right side to the inflation debate

The question of whether the current trend of rising inflation is a transitory or permanent one is not trivial. It is forcing the institutional investor community to reflect on their long-term investment strategies. Investors have to review their current approaches and get ready to make significant changes if their views prove incorrect.

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

-

Features

FeaturesFixed income, rates, currencies: Policy normalisation kicks in

Although several emerging market (EM) central banks have been hiking rates for a few months already this year, particularly in Latin America, it was only in the third quarter of 2021 that the global share of central banks raising official rates moved above 50%. This is the first time in three years that this has been the case, as several developed market central banks joined emerging market counterparts to tighten rates.

-

Opinion Pieces

News Notes: Economies of cost saving

The three main reasons the UK government requested that the country’s 89 Local Government Pension Schemes (LGPS) pool their assets back in 2015 were: establishing common investment vehicles to provide the pension funds with a mechanism to access economies of scale; helping them to invest more efficiently in listed and alternative assets; and reducing investment costs.

-

Country Report

Country ReportFunds collaborate on green credit

Swedish funds team up with fund managers by providing seed money for two new sustainable bond products

-

Features

FeaturesBriefing - CLOs: a post-pandemic resurgence

Exactly a decade after the collapse of Lehman Brothers, the collateralised loan obligation (CLO) market was breaking records. In 2018, nearly $130bn (€113.6bn) worth of CLO paper was issued in the US and €45bn in Europe, a sign that the crisis of confidence caused by the Great Financial Crisis was over.

-

Features

FeaturesBriefing: PE fees under scrutiny

The balance of power between private equity firms and investors typically swings with the fundraising cycles.