All IPE articles in July/August 2024 (Magazine)

View all stories from this issue.

-

Asset Class Reports

Asset Class ReportsNEST’s outsourcing strategy

When NEST was weighing up whether to outsource some of its private markets allocations, the decision was not straightforward.

-

Opinion Pieces

Opinion PiecesThe US perspective on a mixed proxy season

Opinion is divided on whether opposition to environmental and social considerations are increasing following the 2024 annual general meeting season in the US.

-

Asset Class Reports

Asset Class ReportsRegulators shine a light on non-bank lenders

Although private market activity is slowing down, there are fears of systemic risk

-

Features

FeaturesThe next Magnificent Sevens are hiding in plain sight

Like the so-called FANGs that preceded them, one could argue that the Magnificent Seven group of US tech mega-caps that accounted for a large portion of market performance in 2023 are now a part of Wall Street’s history books. Besides two names that have continued to pull away from the pack, the group is no longer commanding investors’ undivided attention.

-

Analysis

AnalysisTowards harmonisation on shareholder rights

Could amendments to the EU’s Shareholder Rights Directive help fix Europe’s splintered voting rules?

-

Country Report

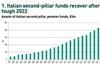

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

Asset Class Reports

Asset Class ReportsPenSam focuses on funds

Four European pension schemes outline their activity in the private credit market

-

Analysis

AnalysisLove it or hate it, ESG is here to stay

The latest wave of regulatory and policy measures will benefit different aspects of ESG investing

-

Features

FeaturesReforms are needed to improve pensions in emerging markets

The emerging world is ageing the fastest. Despite having the advantage of a young population, emerging countries are expected to transition to older age groups within 25 years, a change that took over 150 years in some developed nations.

-

Interviews

InterviewsPreparation is key to countering pensions cyber risk

Pension funds face very real cyber security risks and must prepare for regulatory changes, such as the EU’s Digital Operational Resilience Act. IPE asked European pension funds about their strategies to deal with cyber crime

-

Asset Class Reports

Asset Class ReportsCompenswiss: a newcomer to private credit

Four European pension schemes outline their activity in the private credit market

-

Asset Class Reports

Asset Class ReportsMulti-asset private credit comes to the fore

Investors are increasingly looking at multi-asset private credit mandates for diversification and stable risk-adjusted returns

-

Opinion Pieces

Opinion PiecesA mid-year stock take on ESG: talk is no longer cheap

It’s halftime for 2024, which offers a convenient reason to reflect on where we are with respect to ESG investing. I’d say the outlook is pretty good. That’s because, as global equity impact investor WHEB Asset Management says, the “ESG tourists – asset managers that stampeded into the sustainability market just a few years ago – are now packing their bags” as the depth and breadth of anti-greenwashing regulation bite.

-

Opinion Pieces

Opinion PiecesWhy the green transition throws up workforce and pension challenges

Pensions are a hot topic in corporate Germany, where skills shortages and an ageing workforce have led to a war for talent, as well as a renaissance in occupational retirement provision in the fight for workforce skills.

-

Country Report

Country ReportENPAM looks to preserve cash flow

In February 2024, the board of ENPAM, the first-pillar pension fund for doctors and dentists, approved plans for the fund to transition to an asset liability management (ALM) model that will focus on liability-driven investment (LDI).

-

Asset Class Reports

Asset Class ReportsPublic-to-private borrowing is a two-way street

The private credit boom seems to be drawing to a halt as public funding becomes cheaper

-

Features

FeaturesCyber catastrophe bonds make a debut as insurers offload risk

Cyber catastrophe bonds may be the new kid on the insurance-linked securities (ILS) block, but they have been talked about for years. The jury is out, though, as to whether they will follow the same trajectory as their natural cat bond peers. While some analysts believe they have the potential to go mainstream, others cite concerns over modelling and lack of diversification.

-

Country Report

Country ReportPrevimoda fine tunes for better results

In 2023, Previmoda, the pension fund for the fashion and textile sector, rejigged the strategic asset allocation of its sub-funds Smeraldo Bilanciato, which has a higher exposure to fixed-income, and the equity-focused Rubino Azionario.

-

Country Report

Country ReportCDC pension fund benefits from a steady stream of young members

The Cassa Dottori Commercialisti (CDC) is one of the most sustainable casse di previdenza, the Italian privatised first-pillar funds for professionals, thanks to prudent asset allocation and the CDC’s policy to attract young Italians to the chartered accountancy profession.

-

Analysis

AnalysisDevelopment banks need to be more transparent to mobilise private capital

The UN’s Sustainable Development Goals (SDGs) have caught the imagination of impact-oriented investors, as achieving them requires mobilisation of private capital on a massive scale. However, taking on the risks associated with many of the SDG-oriented investment goals is too much to bear for many private investors.