All Asset Class Reports articles – Page 2

-

Asset Class Reports

Asset Class ReportsDenmark’s Lærernes ups its appetite for private credit risk

Lærernes Pension (LP), the pension fund for teachers in Denmark, started investing in private credit in 2018, in small amounts. In 2021 it made a more sizeable strategic allocation to the asset class.

-

Asset Class Reports

Asset Class ReportsEquities: a return to passive safe havens

In an effort to counterbalance an uncertain economic outlook and geopolitical tensions, many institutional investors are avoiding active management

-

Asset Class Reports

Asset Class ReportsMagnificent seven stocks suck up capital from other sectors

Concentration of US equity markets around a handful of names remains an intractable issue

-

Asset Class Reports

Asset Class ReportsSmall-cap equities struggle as giants surge ahead

Small caps are finding it difficult to make inroads in a world dominated by the Magnificent Seven

-

Asset Class Reports

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

Asset Class Reports

Asset Class ReportsFixed income: European high yield stands its ground

Investors flocked to the European junk bond market last year and despite a strong US economy, there is still appetite for European issuers

-

Asset Class Reports

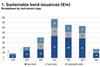

Asset Class ReportsClosing the data gap in green, social and sustainability-linked bonds

Luxembourg’s bourse has capitalised on its experience as a green bond hub

-

Asset Class Reports

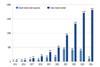

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

Asset Class Reports

Asset Class ReportsIs India’s equity market now the new China in investors’ eyes?

Better governance and a clear economic path may put India in the lead

-

Asset Class Reports

Asset Class ReportsA changing Saudi Arabia proves attractive for investors

Equity market is starting to open to investors as the country liberalises strict rules

-

Asset Class Reports

Asset Class ReportsPrivate debt: Private lending shows signs of recovery

Private credit is showing signs of recovery, but investors are focusing on defensive sectors

-

Asset Class Reports

Asset Class ReportsLegal systems key in emerging market private credit

In the legally complex world of emerging markets, private credit investors naturally favour those with cleaner legal systems

-

Asset Class Reports

Asset Class ReportsUK equities fail to regain their shine

UK pension funds are abandoning domestic equities, and the country’s global weighting in indices has also declined significantly

-

Asset Class Reports

Asset Class ReportsEquities portfolio strategy: Cautious optimism as hard landing fails to materialise in 2023

A shaky European economy will work in favour of quality companies when it comes to stock selection

-

Asset Class Reports

Asset Class ReportsDebt investors face European uncertainty

High interest rates and inflation are the biggest concerns as recession looms

-

Asset Class Reports

Asset Class ReportsFixed income: Investors put weight behind bond markets

Exposure to bonds is rising at the fastest rate since the financial crisis, as investors focus on high-quality paper and the shorter end of the yield curve

-

Asset Class Reports

Asset Class ReportsJapanese stock market finally lives up to expectations

Stocks rally, helped by rising inflation and corporate governance reforms

-

Asset Class Reports

Asset Class ReportsEquities: Making sense of stock market concentration

The level of concentration within global equity markets is at record levels. This has significant implications for portfolio construction

-

Asset Class Reports

Asset Class ReportsAI: Moving from innovation to early adoption

Generative artificial intelligence (AI) capable of generating text, images and even music has stepped into the limelight after decades in the making. It will eventually have an impact across most industries, comparable to the impact of the internet. But while the world may have reached an inflection point in the usage of generative AI, a lot needs to happen before companies are positioned to take full advantage of the developments in large language models (LLMs) such as ChatGPT.