Investment Strategies – Page 2

-

News

NewsMajority of DB schemes expect to approach an insurer about de-risking within five years

86% of trustees anticipate their scheme approaching an insurer for a Bulk Purchase Annuity (BPA) transaction within next five years

-

Features

FeaturesFX in waiting mode after lively 2022

After a long period of muted volatility, currency markets sprang back into action in 2022 as geopolitical risk and diverging monetary policy came to the fore. This year it is quieter, but markets remain rattled over the unpredictable interest rate scenarios. As a result, many market participants are waiting for a sharper picture to emerge.

-

News

NewsIlmarinen anchors new Amundi climate-focused Europe ETF with €580m

Finnish pensions major edges closer to having all its passive equities tracking MSCI’s Climate Action indices

-

News

NewsSwiss pension funds set to change SAA to reach bond investment targets

According to Swisscanto, 17% of pension funds surveyed adjusted their strategic asset allocation, and 35% changed allocations tactically.

-

News

NewsCompenswiss tenders mandate for core+ investments in North American real estate

The scheme plans to diversify its real estate exposure

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Equities

Our report shines a light on investors’ thought processes when it comes to choosing active, passive or a combination of the two. We surveyed CIOs and senior portfolio managers to get an insight into how they construct their equity portfolios. Our report also features an investigation into the fall in listings on the UK equity market, at a time when listing domicile is increasingly consequential aspect of portfolio construction.

-

Interviews

InterviewsVontobel: Builders in a changing landscape

Christel Rendu de Lint, a veteran of Swiss asset and wealth management, sees herself as a builder. This claim has justification given her track record at UBP, where she built a fixed-income capability from scratch to CHF20bn (€20.5bn) over 12 years.

-

Special Report

Special ReportOutlook – Europe and the world: CIOs focus on bonds and quality stocks

With the prospect of weaker growth, volatility and higher inflation and rates, strategists argue for more selectivity in investments

-

News

NewsKENFO plans to invest over €5bn in alternatives to reach allocation target

The fund has 6% of its total assets invested in alternatives, but plans to build up its illiquids portfolio over the years

-

News

NewsIIGCC launches net zero guidance for private equity

Guidance is intended to support any private equity investors who are active in buyout, growth, and associated strategies

-

News

NewsComPlan to look at UN SDGs in private equity, debt investments

The scheme included physical and transitional climate risks in an ALM analysis for the first time last year

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income

Last year ushered in a new era for global fixed income and credit markets. It was the worst, in terms of returns, for bond investors in years, but it signalled a regime change. Investors need to be prepared for structurally higher inflation and rates, as well as higher volatility. But for fixed income managers, this is an environment where value is easier to find. Our report looks at this new beginning for fixed income investors, and at how selectivity has become key in the high yield and loan markets.

-

Features

FeaturesResearch: Thematic investing is set to attract fresh capital

In the second article on the new Amundi-Create Research survey, Vincent Mortier and Amin Rajan highlight pension plans’ interest in thematic investing

-

News

NewsSwiss pension fund association lays out ESG reporting standards

Pensionskassen would publilsh qualitative statements on the goals and principles of their sustainability strategies

-

Special Report

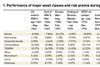

Special ReportProspects 2023: The inflation conundrum facing investors

Institutional investors would do well to include commodities and trend strategies to mitigate inflationary pressures

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Diversification and dislocation in a place called dystopia

What happened to my free lunch? They told me that diversification was there for the taking, yet there has been no zig to my zag. They promised me downside protection, but all I see is red. They said liquidity was a benefit, but never mentioned the bid/ask spread. Welcome to dystopia in the era of dislocation.

-

News

German sustainable finance committee sets priorities for legislative period

Committee lists reporting, financing the economic transformation, and start-ups among its priorities

-

News

Sampension pushes on with inflation-linked bonds, real assets build up

Danish pension fund uses perceived mispricing, systematic rebalancing tactics to add extra returns

-

Special Report

Special ReportFour challenges for asset managers

Leading figures respond to key questions on ● Investment strategy ● ESG

-

News

Pension Protection Fund sets strategic priorities for next three years

The fund is currently conducting a planned review of its funding strategy