All Equities articles – Page 9

-

News

NewsSwedish agency outlines next €17bn of premium pension tenders

FTN flags first index categories as next two procurements at end 2023 or early 2024

-

News

NewsKLP posts Q3 loss after NOK6bn property write-down

Norwegian pensions major says competitive situation stable, despite losing two municipal clients

-

Asset Class Reports

Asset Class ReportsJapanese stock market finally lives up to expectations

Stocks rally, helped by rising inflation and corporate governance reforms

-

Asset Class Reports

Asset Class ReportsEquities: Making sense of stock market concentration

The level of concentration within global equity markets is at record levels. This has significant implications for portfolio construction

-

Country Report

Country ReportSwedish Fund Selection Agency ramps up procurement

As the first round of tenders for the country’s new premium pension system comes to a close, agency is preparing for the next ones

-

Asset Class Reports

Asset Class ReportsAI: Moving from innovation to early adoption

Generative artificial intelligence (AI) capable of generating text, images and even music has stepped into the limelight after decades in the making. It will eventually have an impact across most industries, comparable to the impact of the internet. But while the world may have reached an inflection point in the usage of generative AI, a lot needs to happen before companies are positioned to take full advantage of the developments in large language models (LLMs) such as ChatGPT.

-

Opinion Pieces

Opinion PiecesActive management is back on the menu for US pensions

Rising rates and market volatility are forcing US pension funds to rethink their approach to passive and active investing. They are realising that their US stock portfolios are not diversified enough to help protect against a correction. But change may not come so fast.

-

Features

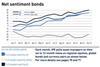

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

News

NewsPFA predicts late-year boost for stocks as interest rates stabilise

Danish pensions giant still has ‘good exposure’ to tech’s big-seven stocks, and banks and pharma, says Choi Danielsen

-

News

NewsNorwegian SWF manager defends securities lending

Folketrygdfondet’s bonds chief Sæbø says lending shares ‘naturally belongs to a long-term investor’

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

News

NewsPKA extends green credentials to swaps exposure with $1bn Osmosis deal

Danish labour-market pensions firm uses new product as Osmosis fills “important gap in the market”

-

News

NewsInarcassa’s new strategy sees cuts to equity in favour of bonds, infrastructure

Assets under management for first-pillar pension schemes, according to pension regulator Covip

-

News

NewsNBIM’s active management limits SWF’s portfolio-wide Q3 loss

Value of Norwegian GPFG falls back on negative investment returns and falling krone

-

Analysis

AnalysisInvestors look to isolate China from EM equity portfolios, says bfinance

Several of bfinance’s institutional clients are reportedly on the verge of cutting out China from their main emerging market equity exposure

-

News

NewsSampension sticks to cautious equity tactics, with central banks in a bind

Danish labour-market pensions firm regrets early roll-back of equities exposure

-

News

NewsAlecta’s investment scandal claims another scalp as chair Ingrid Bonde quits

Bonde says she decided to resign because of ‘too much focus on me personally’

-

Special Report

Special ReportCase study: Ilmarinen - Building a climate-focused future

Finland’s second-biggest pension provider is a keen investor in exchange-traded funds (ETFs), having allocated more than €6bn to a range of equity vehicles in recent years.

-

Analysis

AnalysisUK pension industry reacts to government’s ambitious Mansion House Reform agenda

September saw the close of key pension reform consultations. Pamela Kokoszka and Liam Kennedy assess the proposals and some of the responses

-

News

NewsAkademikerPension sees positive return impact after shedding last oil/gas major

Danish occupational pension fund divests Italy’s Eni, excluding last large upstream oil and gas company in its portfolio