Fixed Income – Page 5

-

Asset Class Reports

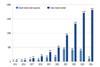

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Interviews

InterviewsMerseyside pension fund dials down domestic bias

Scheme’s strategic ambition is to move closer to the MSCI World index weightings

-

Opinion Pieces

Opinion PiecesBond markets look set to become the new stewardship powerbroking arena

Investors in bond markets are starting to assume a more powerful position than equity investors to influence companies and countries. Innovation is sweeping through bond markets with the introduction of specific ‘use of proceeds’ bonds and sustainability-linked bonds.

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

News

NewsEnel KPI miss ‘a watershed moment’ for sustainability-linked bond market

Price reaction was swift, with the affected SLBs outperforming unaffected Enel instruments by 0.59% on average

-

News

NewsCassa Forense seeks asset managers for investment vehicles worth €4bn

The lawyers scheme is creating the two vehicles to streamline investments and administration of its assets

-

News

NewsAlecta, APK back $436m Amundi-IFC impact-oriented EM bond fund

Public-private partnership aims to encourage issuance of green, social and sustainability-linked bonds in emerging markets

-

News

NewsPublica sets up bespoke ESG benchmarks for EM government bonds

It worked with 17 asset managers on guidelines intended to increase transparency on ESG for investments in corporate loans, infrastructure, and real estate mortgages

-

Features

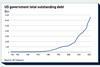

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

-

Opinion Pieces

Opinion PiecesATP at 60: no plans to retire the guaranteed pensions model

Now approaching retirement age itself, Danish statutory pension fund ATP is using its 60th birthday as an opportunity to reinforce the validity of its guarantee-based investment model.

-

Special Report

Special ReportRound table: Manager selection priorities for 2024

IPE asked eight manager research business leaders: what will be the three most important topics or trends in manager selection over the next 12 months and beyond?

-

Features

FeaturesIPE Quest Expectations Indicator - April 2024

The shadow of the US presidential elections is longer than normal because Trump is under several legal clouds. He could still get barred from participating but that seems unlikely. He does have a liquidity problem, a self-destructive streak, a mercurial character and no credible alternative waiting in the wings, though.

-

News

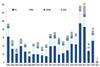

NewsGerman institutional investors boost corporate bonds allocation

Investments in government bonds fell from more than 36% to just over 30% of total allocations

-

News

NewsSwiss Bayer Pensionskasse realigns investment strategy

Allocations to bonds increase, while exposure to mortgages and real estate decrease

-

Features

FeaturesSecuritised credit keeps on shining

For a market with a difficult past, some could even say an image-problem, securitised credit has been performing remarkably well in recent years.

-

Features

FeaturesContrasting global economic growth fortunes

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.

-

Features

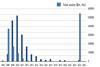

FeaturesA bumper year for convertible bond issuance

The convertible bond market ended 2023 on a strong note with its main index – the Refinitiv Global Focus – returning 6% in the fourth quarter. The optimism has continued into 2024 on the back of reasonable valuations, historically low equity volatility and better opportunites.

-

Features

FeaturesIPE Quest Expectations Indicator - March 2024

Climate change is coming to a trend break as the low-hanging fruit has been picked.

-

News

NewsLGPS Central seeks sterling investment grade credit manager via IPE Quest

The UK investment pool is expected to funded the mandate in mid-2024 with a total value of around £600m

-

News

NewsBVV to assess climate impact of sovereign bonds portfolio

The scheme uses the X-Degree-Compatibility (XDC) model by climate tech company Right