Government Bonds – Page 3

-

Opinion Pieces

Opinion PiecesATP at 60: no plans to retire the guaranteed pensions model

Now approaching retirement age itself, Danish statutory pension fund ATP is using its 60th birthday as an opportunity to reinforce the validity of its guarantee-based investment model.

-

News

NewsGerman institutional investors boost corporate bonds allocation

Investments in government bonds fell from more than 36% to just over 30% of total allocations

-

Interviews

InterviewsMuzinich’s Tatjana Greil Castro on credit fundamentals

In one of the meeting rooms of the London office of Muzinich & Co are displayed a series of bond certificates from the past.

-

Features

FeaturesA bumper year for convertible bond issuance

The convertible bond market ended 2023 on a strong note with its main index – the Refinitiv Global Focus – returning 6% in the fourth quarter. The optimism has continued into 2024 on the back of reasonable valuations, historically low equity volatility and better opportunites.

-

News

NewsBVV to assess climate impact of sovereign bonds portfolio

The scheme uses the X-Degree-Compatibility (XDC) model by climate tech company Right

-

Features

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Asset Class Reports

Asset Class ReportsFixed income: Investors put weight behind bond markets

Exposure to bonds is rising at the fastest rate since the financial crisis, as investors focus on high-quality paper and the shorter end of the yield curve

-

Interviews

InterviewsBarings: A bond investor for changing times

Martin Horne is the new global head of public assets at Barings bond investor, but he is a bond guy through and through.

-

Features

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Features

FeaturesIPE Quest Expectations Indicator - January 2024

It is safe to predict that 2024 will be a year of desperate campaigning. Political surprises in the US and UK are possible and, this time, they do make a difference to markets

-

News

News‘Milestone’ as investor-led project delivers first country climate assessments

ASCOR framework assesses countries in 13 topic areas for benefit of sovereign bond investors

-

News

NewsPublica uses democracy index to invest in government bonds

The scheme excludes countries violating basic democratic principles

-

Opinion Pieces

Opinion PiecesInvestors should focus on debt sustainability

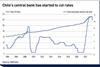

The good news for institutional investors as 2024 approaches is that central banks seem to have accomplished something remarkable. Inflation is falling in the US and Europe after rising to levels not seen for decades, thanks to what have been among the fastest and sharpest rate hikes. Economic growth has held up, at least in the US. Many economists expect a soft landing there, and a mild recession in Europe.

-

Special Report

Special ReportProspects special report 2024: CIOs on what awaits investors

Asset management CIOs and strategists answer key questions about investment for the 12 months and beyond

-

Features

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

News

NewsSpanish pension funds mirror global market surges with 2.3% return to June 2023

Asset allocation figures show that fixed income still dominates portfolios, although in declining proportions, with an average 55.3% allocation at end-June

-

Special Report

Special ReportFocus returns to fixed income ETFs

Fixed income is back, baby! In the seven months to the end of July 2023, flows into European-domiciled fixed income exchange-traded funds were €39bn compared with €14bn for the same period last year, according to Morningstar.

-

Features

FeaturesInversion anxiety: what’s up with yield curves in 2023

For over half a century, each time the spread between US 10-year and three-month yields turned negative, indicating an inverted yield curve, a recession followed, sooner or later. In 2023, the yield curve has been more than just a little inverted.

-

Features

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.