United States – Page 5

-

Features

FeaturesCredit investors ready for a possible US recession

Although 2023 has been ‘interesting’ so far, it has also provided relief after the challenges and financial asset mayhem of 2022, and a wide range of asset classes have posted positive returns to date.

-

Opinion Pieces

Opinion PiecesNBIM’s Shanghai exit: more than ‘operational’ adjustment’

When Norway’s sovereign wealth fund announced in September it was shutting down its only office in China, the move was bound to be seen as symbolic of the deteriorating relationship between China and the US and its allies. It also came at a low-point for investment in China, with foreigners having sold off a record CNY90bn (€11.5bn) of Chinese stocks in August, amid fears over China’s tensions with the West, its property crisis and weak post-COVID economic recovery.

-

Features

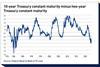

FeaturesInversion anxiety: what’s up with yield curves in 2023

For over half a century, each time the spread between US 10-year and three-month yields turned negative, indicating an inverted yield curve, a recession followed, sooner or later. In 2023, the yield curve has been more than just a little inverted.

-

News

NewsAP2 helps German think tank develop portfolio tool to assess deforestation risk

In work funded by Californian philanthropists, Swedish national pensions buffer fund says publicly-accessible workflow will be tested on AP2’s listed equities

-

News

NewsUS Treasury releases net zero financing and investment principles

Secretary Yellen says goal is to ‘affirm importance of credible net zero commitments’

-

![RobertGEcclesPhoto[1]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/8/2/3/142823_robertgecclesphoto1_404467_crop.jpg) Opinion Pieces

Opinion PiecesESG remains mired in politics in the US

“I am not going to use the word ESG because it’s been misused by the far left and the far right,” said BlackRock CEO Larry Fink in a conversation at the Aspen Ideas Festival in June.

-

Features

FeaturesThe US dollar’s declining status as a global reserve currency

The recent US debt ceiling negotiations have brought into question the viability of the US dollar’s status as a global reserve currency. Long-term investors have been reviewing their strategic asset allocation away from the currency, seeking to diversify their exposure and to take advantage of long-term investment opportunities.

-

Features

FeaturesDiscerning investor sentiment: this year’s proxy season

Every annual general meeting (AGM) season has traditionally brought with it a few symbolic moments – events that serve as broader indicators of the market’s mood when it comes to environmental and social issues.

-

Features

FeaturesFixed income, rates & currency: US debt crisis averted – what next?

The US debt ceiling crisis was resolved in June, avoiding potentially major fireworks, with a suspension of the limit until early 2025. This ensures that the next time the politicians have to fight about it will be after the November 2024 presidential election. Although markets were relieved at the temporary resolution, the process of rebuilding the very depleted Treasury cash balances – with some huge bill auctions planned – will drain significant liquidity from the system, which could put pressure on the rates market.

-

Opinion Pieces

Opinion PiecesLetter from US: Annuities move into the US market

Three of the largest players in the US pension industry are launching new products that offer annuities as a retirement savings distribution option. Millions of Americans will soon have access to pension-like investments in their 401(k) plans thanks to BlackRock, Fidelity Investments, and State Street Global Advisors. The other large player in the US market, Vanguard, will not take part in this new trend.

-

Special Report

Special ReportSpecial Report – Outlook: Europe and the world

Inflation may be losing momentum, thanks to vigorous central bank action, but with a recession on the horizon, it is hard to tell whether the next few months and years will see markets turn around and risk assets begin to perform again. For the time being, CIOs argue for selectivity in stock selection and generally agree that bonds have resumed their diversification role. The main article in our Outlook report features the views of influential CIOs and strategists on asset allocation for the next few years.

-

Opinion Pieces

Opinion PiecesUS: state enrolment systems gain traction

There are signs that the US state-facilitated retirement savings plans are starting to have a positive impact on both the creation and uptake of private pension plans.

-

Asset Class Reports

Asset Class ReportsEquities – Does location matter in the corporate listings debate?

The number of listed companies have fallen dramatically, but London remains a preferred global financial centre

-

Special Report

Special ReportOutlook – Europe and the world: US overtakes Europe in clean-energy production

Incentives package for US-based clean energy investments is seen by some as a threat to Europe’s industrial competitiveness

-

Features

FeaturesBlackRock executive pegs inequality with new opportunity index

“Inequality is both a risk and an opportunity that should be measured,” says Gavin Lewis in a conversation about his book ‘The Opportunity Index: A solution-based framework to dismantle the racial wealth gap’. Growing up in a single parent household without a father in Tottenham, a predominantly black area of London with high poverty levels, Lewis is well qualified to have a view on inequality. But as a managing director at BlackRock, is he also an example of the exception that proves the rule?

-

Special Report

Special ReportOutlook – Europe and the world: UK launches its own approach to green investment

The focus is on financial regulation rather than economic policy to drive decarbonisation

-

Opinion Pieces

Opinion PiecesUS: Politics drive ESG debate

Three Republican candidates for the White House are vocal advocates against pension funds adopting environmental, social and governance (ESG) investment practices.

-

News

NewsIlmarinen anchors biggest ETF launch yet

Finnish pensions giant prompts creation of tracker fund based on new MSCI climate index – switching €1.86bn into new ETF

-

News

NewsAlecta fires equities chief; hires acting CIO as Billing slashes foreign holdings

Sweden’s largest pensions institution makes rapid changes to shore up public confidence after US bank losses

-

News

NewsBank demises isolated, but VER’s CEO warns of wider crisis if rates stay high

Timo Löyttyniemi says collapse of SVB and forced sale of Credit Suisse only indicate problems with certain individual banks