United States – Page 6

-

Opinion Pieces

Opinion PiecesUS: Private equity losses weigh on pension funds

US public pension funds should brace for a big negative surprise when they prepare their reports for the fiscal year ending 30 June 2023. Only then will their returns reflect losses from 2022 in their private equity (PE) portfolios.

-

News

NewsSweden’s AP funds gather pension majors to coax tech giants on human rights

AP Funds’ Council on Ethics convenes institutional investor group including Railpen, APG, PGGM and USS for joint engagement with Alphabet, Meta and others

-

News

NewsAlecta’s board orders immediate strategy probe after US bank losses

Swedish occupational pensions giant says its First Republic Bank investment risks being completely lost too

-

News

NewsSwedish watchdog grills Alecta, others as US bank losses pile up

NBIM ‘closely monitoring the situation in the market’ after €281m exposure to collapsed banks

-

News

NewsAlecta says it’s solid despite losing €1.3bn on US banks in days

Silicon Valley Bank, Signature Bank collapses erase 1% of Swedish pensions giant’s portfolio

-

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

-

Features

FeaturesCentral banks and the weaponisation of finance

The US has been a global power since the second world war. But it was during the interval between the collapse of the USSR in 1991 and the rise of China in the 21st century that the US was perhaps the single global hegemon.

-

Features

FeaturesUS: SECURE 2.0 means the hard work ahead for pension plan sponsors

On one thing pretty much everyone agrees: the new SECURE 2.0 Act is very broad, complex, and will create a lot of work for US plan sponsors and retirement providers. In fact, the Setting Every Community Up for Retirement Enhancement law includes over 90 different provisions.

-

Opinion Pieces

Opinion PiecesUS: Sponsors back pension buyouts

In 2022, pension risk transfer (PRT) deals in the US reached a record of over $50bn (€46.5bn), according to estimates. And many industry observers expect demand from plan sponsors for PRT solutions to remain strong in 2023.

-

Features

FeaturesWill the US pushback against ESG slow global progress?

Hostility towards asset managers embracing climate action and stewardship is raising questions on both sides of the Atlantic

-

Opinion Pieces

Opinion PiecesUS: Republican House will not divert from SECURE 2.0

The new Republican majority in the US House of Representatives is not large enough to have a significant impact on the retirement industry.

-

News

KLP on Vanguard: ‘NZAM not the only way of working for net zero’

Norwegian municipal pensions giant says finance sector must come together and push for transformation in portfolios, markets

-

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.

-

News

NewsAP7 sues US gaming firm and Microsoft over planned merger

Swedish pensions giant alleges bid process not done correctly, disadvantaging Activision shareholders

-

News

PenSam, Greater Manchester demand tax transparency from ConocoPhillips

Danish and UK pension funds challenge US oil giant, co-filing shareholder resolution alongside Oxfam America

-

Features

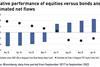

FeaturesThe rising influence of target-date funds on capital markets

One of the fastest growing markets in recent years is the US retirement market. Since 1995, the investment volume has increased six-fold, so that by the end of 2021, the market stood for almost $40trn (€40.1trn) AUM.

-

Opinion Pieces

Opinion PiecesUS: Pension plans face up to a tough 2022

After the terrible returns of the fiscal year that ended in June, what will US public pension funds do? Will they increase their risky investments to try to reach their target returns? Or will they lower their target returns?

-

Opinion Pieces

Opinion PiecesUS: Transparency concerns over SEC private market disclosure rules

Will the US Securities and Exchange Commission’s (SEC’s) new climate risk reporting rules bring more transparency to private markets? Or will they have the unintended consequences of increasing the opacity of the markets?

-

News

KLP banishes US prison stocks due to refugee treatment

Norwegian municipal pensions giant finds little credibility in reassurance from CoreCivic and GEO Group

-

Opinion Pieces

Opinion PiecesUS: The great unfreeze - does it make sense to reopen DB plans?

US defined benefit (DB) public and corporate pension funds are responding differently to inflationary pressures. Public schemes are more concerned about the negative impact of financial market turmoil on their returns, while corporates are enjoying the rising discount rates that are lowering their liabilities and improving their funded status.