China – Page 2

-

Asset Class Reports

Asset Class ReportsIs India’s equity market now the new China in investors’ eyes?

Better governance and a clear economic path may put India in the lead

-

Interviews

InterviewsPension funds revisit allocations to China

European pension funds have reduced their allocations to China as the outlook for the country’s economy becomes more uncertain

-

News

NewsP+ divests 10 Chinese stocks on solar cell forced labour risk

“Solar cell production is one of the industries where the risk of links to forced labour is very high,” says pension fund’s responsible investments chief

-

News

NewsAPG closes Beijing office

APG had anticipated greater interest in local currency bond strategy it ran from the office in partnership with local asset manager E-Fund Management

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Features

FeaturesThe great desyncronisation age in global financial markets

Investors are witnesses to the end of an era of synchronised global growth, when China could be counted on for outsized expansion that provided a broad cross-border lift for economies, industries and asset classes.

-

News

NewsKLP flies to China to overcome mining company brush-offs

If mining companies don’t take responsibility, KLP may exclude them from the portfolio, says Kiran Aziz

-

Asset Class Reports

Asset Class ReportsCorporate borrowers in emerging markets put to the test

Many emerging market companies have healthy balance sheets and weathered the COVID crisis well. How will they fare if global growth slows?

-

Asset Class Reports

Asset Class ReportsLocal currency emerging market bonds are back in the spotlight

Partly thanks to the weakening of the US dollar, local currency emerging market sovereigns are now offering healthy yields, and should continue to perform well

-

Opinion Pieces

Opinion PiecesNBIM’s Shanghai exit: more than ‘operational’ adjustment’

When Norway’s sovereign wealth fund announced in September it was shutting down its only office in China, the move was bound to be seen as symbolic of the deteriorating relationship between China and the US and its allies. It also came at a low-point for investment in China, with foreigners having sold off a record CNY90bn (€11.5bn) of Chinese stocks in August, amid fears over China’s tensions with the West, its property crisis and weak post-COVID economic recovery.

-

News

NewsNorway’s SWF axes Shanghai office

NBIM says decision to close only Chinese branch doesn’t affect its investment strategy or China assets

-

Special Report

Special ReportAsia Investment - Special Report

In this month’s special report on Asia, IPE’s private markets editor Lauren Mills analyses why global institutional investors are setting their sights on Asia. The combination of strong fundamentals and a lack of correlation with the European and North American economies make the region’s private assets particularly attractive. Investors are particularly hungry for infrastructure assets as well as the region’s fast-growing digital infrastructure.

-

Special Report

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky

-

News

NewsPensioenfonds Vervoer doubles real estate investments

The fund has also adopted a new country policy, excluding investments in China and two dozen other countries

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Investors watch as China corrects course

The Chinese government has managed to restart the economy post-COVID, but investors are cautious

-

Features

FeaturesThe West should understand the strengths and limitations of Enterprise China

China is fast becoming the West’s bogeyman. Yet a hard decoupling of the two would be a lose-lose situation for both. Despite the tensions, private companies face the challenge of creating viable strategies for interactions with China that could make the difference between success and bankruptcy.

-

Interviews

InterviewsNikko Asset Management: Complex, creative thinking

Stefanie Drews is at home with complexity. She speaks several languages fluently, including Japanese, and tells us she still does her maths in Italian.

-

Opinion Pieces

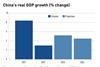

Opinion PiecesViewpoint: China - Reopening should drive growth

After a year of anaemic growth – by China’s standards – we expect a recovery in Chinese economic activity to gradually take place in 2023

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality

-

Special Report

Special ReportSpecial Report – Prospects 2023

The past year will be remembered as one of the most challenging for institutional investors ever. The outlook for 2023 is brighter, if anything because valuations of major asset classes have come back to historical levels.