Private Debt – Page 5

-

News

NewsComPlan to look at UN SDGs in private equity, debt investments

The scheme included physical and transitional climate risks in an ALM analysis for the first time last year

-

News

NewsItaly roundup: BCC-CRA pension fund divests from private markets

Plus: Fondo Priamo increases number of members and contributions; Enpaia cuts real estate investments

-

Country Report

UK: One way for DC schemes to access private markets

There is much debate about mark-to-model valuation methodologies and whether a material economic downturn will cause these to catch up with public market price falls, but the history books will show that portfolios with allocations to private markets were more robust than those with none in 2022 – the worst year on record for traditional balanced portfolios.

-

News

NewsAP7 to invest 20% of total assets in alternatives

The buffer fund is looking into private equity, infrastructure and real estate

-

News

BaFin warns of further risks for Pensionskassen

Risks are perceived from investments in Spezialfonds and alternative investments, as well as in private equity and private debt funds

-

News

NewsIncome generation drives private markets investments in 2023, BlackRock finds

More than 70% of respondents globally intend to increase their allocations to private equity this year

-

Interviews

InterviewsPension funds on the record: In-house due diligence of private debt managers pays off

Experienced alternative credit investors find that risk-adjusted returns are better than in the more liquid credit markets

-

Opinion Pieces

Opinion PiecesGuest viewpoint: LDI regulation should not ignore private asset solutions

In the aftermath of the liability-driven investing (LDI) crisis, The Pensions Regulator (TPR) in the UK drew up guidelines for pension funds to improve the resilience of LDI strategies. These guidelines primarily aim to support the creation of liquidity buffers so that pension funds can withstand yield shocks. To that end, the guidelines advise pension funds to conduct stress tests and identify suitable collateral with respect to both leveraged and unleveraged LDI strategies using yield-shock scenarios.

-

News

NewsInarcassa hedges equity exposure, resumes private markets allocations

According to the new strategic asset allocation for 2023, Inarcassa is increasing its allocation to bonds by 3%, while reducing equities by 1.5%

-

News

NewsPrivate debt managers seek to tackle climate change – IPE research

The vast majority of private lenders include ESG T&Cs in financing agreements, with a quarter including net-zero targets

-

News

NewsVER to increase private asset weighting as new rules give scope

Finnish buffer fund behind central government pensions aims to broaden private assets allocation by three points

-

Country Report

Country ReportGermany: Financing the Energiewende

German professional pension funds like ÄVWL and BVK are keen to support the energy transition process

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Private debt

The rise in interest rates and inflation throughout 2022 brought traditional fixed-income assets back into focus for investors. The threat of a recession, the pressure on investors to maintain liquidity in portfolios and the ‘denominator effect’, which sees investors over-allocated to unlisted assets after a torrid 2022 for listed equities and bonds, are all facts that would suggest that private debt markets will suffer. However, investors are still backing experienced private debt managers and allocations to the asset class are forecast to grow further in the medium term.

-

Asset Class Reports

Asset Class ReportsPrivate debt: Sustainable lending set for comeback

Issuance of sustainability-linked paper took a hit in 2022, but managers are now introducing ESG KPIs to incentivise borrowers

-

Asset Class Reports

Asset Class ReportsPrivate debt: Managers take back control

Steady demand for private credit puts lenders in a strong position to negotiate beneficial terms, but discipline in lending remains crucial

-

Interviews

InterviewsPension funds on the record: Private debt is not all it’s cracked up to be

Investment in the asset class has grown exceptionally in recent years among pension funds, but to some investors the risk-return profile is not attractive enough

-

Asset Class Reports

Private debt: European markets try to power ahead

Private debt in Europe is still feeling the impact of the war in Ukraine and the surge in inflation, but there are reasons for optimism

-

Asset Class Reports

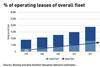

Asset Class ReportsPrivate debt: Leases make plane sense after COVID

With plenty of pent-up demand for air travel, aeroplane operating leases may be an attractive investment option

-

News

NewsCompenswiss expands private debt programme

The Swiss pension fund is looking for managers to invest in senior corporate direct lending in Europe and in the US

-

News

NewsEnpam and Fon.Te push on with private markets investments

Enpam plans to invest €290m in private equity, venture capital and private debt, while Fon.Te has earmarked €380m for private markets