Sustainability – Page 11

-

News

NewsBrightwell drops head of sustainable investment role after Barron exit [updated]

Victoria Barron resigned after four years at the organisation to explore new opportunities in sustainable investment

-

News

NewsPGB to focus sustainable investments on biodiversity, food systems

70% of members of the €37bn Dutch multi-sector fund support a focus on sustainability, according to a recent survey

-

News

NewsSFDR feedback report confirms market split over labelling categories

Feedback summary report shows market is undecided over what it wants from next steps for Sustainable Finance Disclosure Regulation (SFDR)

-

News

NewsEU mulls lower capital charges for blended finance

Commission urged to reclassify public-private investments to bolster SDG-related capital flows

-

News

NewsEFRAG, ISSB release joint guidance on sustainability reporting

The new document is designed to address complexities and reduce duplication in sustainability reporting

-

News

NewsISSB’s digital taxonomy to help investors assess sustainability disclosures

The ISSB Taxonomy will enable investors to search, extract and compare sustainability-related financial disclosures as ISSB establishes its global baseline of standards

-

Analysis

AnalysisSmall island states turn to institutional investors to protect oceans

Small island developing states may have a total population of only around 65 million, but through their exclusive economic zones they control about 30% of oceans and seas, according to the International Institute for Sustainable Development (IISD).

-

Asset Class Reports

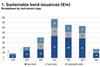

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

Asset Class Reports

Asset Class ReportsClosing the data gap in green, social and sustainability-linked bonds

Luxembourg’s bourse has capitalised on its experience as a green bond hub

-

Asset Class Reports

Asset Class ReportsGreen bonds reach escape velocity

The green bond market looks set to grow further, despite pressure from many sides and key questions over their function

-

Opinion Pieces

Opinion PiecesStriking the right balance on pension funds and fiduciary duty

Pension fund investment principles, strategies and decision-making have all become more complex in the wake of the growth of sustainability factors in general and climate change in particular. This has made the interpretation and practice of trustee ‘fiduciary duties’ more vexed and challenging than ever. A recent review of fiduciary duties in the UK by the Financial Markets Law Committee (FMLC) put it this way: “It is sometimes easier to state the duties than it is to apply them.”

-

Opinion Pieces

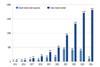

Opinion PiecesBond markets look set to become the new stewardship powerbroking arena

Investors in bond markets are starting to assume a more powerful position than equity investors to influence companies and countries. Innovation is sweeping through bond markets with the introduction of specific ‘use of proceeds’ bonds and sustainability-linked bonds.

-

Interviews

InterviewsSweden’s AP3 pension fund and its quest for alpha

Jonas Thulin, recently appointed CIO of Sweden’s Tredje AP-Fonden (AP3), talks to Carlo Svaluto Moreolo about his approach to asset allocation and portfolio management

-

News

NewsEnel KPI miss ‘a watershed moment’ for sustainability-linked bond market

Price reaction was swift, with the affected SLBs outperforming unaffected Enel instruments by 0.59% on average

-

News

NewsArticle 9 funds outflows continue amid ongoing regulatory uncertainty

Flows into Article 8 funds rebounded after three quarters of outflows

-

News

NewsISSB to tackle biodiversity reporting, human capital disclosures

Chair Emmanuel Faber says the board’s focus remains on the informational needs of investors and the allocation of capital

-

News

NewsIASB to consult on accounting for climate-commitments

The board agreed to issue the proposed guidance, which is subject to drafting changes, on a 120-day comment period

-

Analysis

Corporate Sustainability Due Diligence Directive final text gets green light

MEPs have now signed-off on an agreement which means the law will only apply to very large companies

-

News

NewsEthos expects UBS to tighten lending policy for high emission sectors

The foundation is asking UBS to phase out from high emission sectors such as thermal coal

-

News

NewsMandate nature transition plans, finance sector urges governments

Although climate transition plans must incorporate nature, there is a specific need for dedicated nature transition plans