All articles by Carlo Svaluto Moreolo – Page 4

-

Features

FeaturesHow the AT1 bond market shrugged off the Credit Suisse debacle

On a late Monday evening in August, the Italian right-wing government unexpectedly announced a new 40% tax on banks’ ‘windfall’ profits derived by the higher lending rates. Shares in Italian banks tumbled, banking executives cried foul, and analysts poured scorn over the measure. The government, which was hoping to raise up to €3bn to help families and small businesses, backtracked shortly after, scaling back the tax.

-

Country Report

Country ReportItaly: Pension investors raise their sustainability game

Pension funds and other institutions are making greater use of engagement and voting as they pursue their ESG goals

-

Country Report

Country ReportItaly: Byblos consolidates private markets portfolio

The industry-wide fund has opted for a single external multi-asset mandate for private equity, private debt and infrastructure

-

Opinion Pieces

Opinion PiecesLessons learned from Berlusconi’s pension reforms

To some, the death of Silvio Berlusconi on 12 June this year, is the end of an era for Italian politics. Berlusconi was the longest-serving prime minister in the history of the republic and a highly controversial figure, at home and abroad. He can be described as the first modern European populist leader.

-

Asset Class Reports

Asset Class ReportsFixed income & credit – No turning back for alternative credit

Investor demand for alternative lending strategies remains strong as the opportunity set grows

-

Interviews

InterviewsSweden's AP3: Adding value through active management

Pablo Bernengo, CIO of Tredje AP-fonden (AP3), talks to Carlo Svaluto Moreolo about the fund’s active approach to investment

-

Interviews

InterviewsFinland's VER: The strategy to secure government pensions

Timo Löyttyniemi (pictured), CEO of the buffer fund supporting Finnish government employees’ pensions, talks to Carlo Svaluto Moreolo about its investment strategy

-

Asset Class Reports

Asset Class ReportsEquities – Testing times for high-conviction equity strategies

Today’s environment may favour stock picking, but investors continue to face pressures to justify the added risks

-

Special Report

Special ReportOutlook – Europe and the world: CIOs focus on bonds and quality stocks

With the prospect of weaker growth, volatility and higher inflation and rates, strategists argue for more selectivity in investments

-

Opinion Pieces

Opinion PiecesDo not blame institutions for taking risks

Alecta, the SEK1.19trn (€105bn) institution that manages the Swedish ITP private-sector pension scheme, is being probed by Swedish regulators for the €1.9bn capital loss it experienced earlier this year, as the three US regional banks it invested in – Silicon Valley Bank, Signature Bank and First Republic Bank – collapsed. The institution reacted by firing its influential CEO Magnus Billing.

-

News

NewsNew PPF proposals would represent ‘seismic changes’ to UK pensions landscape

Plans would mean ‘struggling’ DB schemes could choose to opt-in to the Pension Protection Fund

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over

-

Opinion Pieces

Opinion PiecesBlame will not solve the issues raised by the LDI crisis

The chain of events that led to the UK’s liability-driven investment (LDI) crisis, a high-profile inquiry by the UK Parliament, and a time of anxiety and introspection in the country’s pension industry, started well before then prime minister Liz Truss’s government and its somewhat reckless ‘growth plan’.

-

Opinion Pieces

Opinion PiecesEmerging market investors should take the long view

For institutional investors, investing in emerging markets is a true test of fiduciary duty. The asset class – if it can be defined as such – has enormous potential, yet it is also risky, not just in terms of volatility but also of reputation.

-

Interviews

InterviewsPZU TFI: Building the future of Polish pensions

Marcin Żółtek (pictured), CEO of PZU TFI, one of Poland’s largest managers of DC pension savings, tells Jakub Janas and Carlo Svaluto Moreolo about the firm’s role in the Polish pension system

-

Features

FeaturesUkraine: The mother of all impact investments

Institutional investors can play a crucial role in rebuilding Ukraine in a post-war future

-

Asset Class Reports

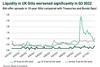

Asset Class ReportsPortfolio strategy – Private debt

The rise in interest rates and inflation throughout 2022 brought traditional fixed-income assets back into focus for investors. The threat of a recession, the pressure on investors to maintain liquidity in portfolios and the ‘denominator effect’, which sees investors over-allocated to unlisted assets after a torrid 2022 for listed equities and bonds, are all facts that would suggest that private debt markets will suffer. However, investors are still backing experienced private debt managers and allocations to the asset class are forecast to grow further in the medium term.

-

Interviews

InterviewsBain Capital: Vintage private equity

“In our world, it is quite easy to describe what we do, but it is very hard to do it,” says Robin Marshall, partner at Bain Capital. That statement encapsulates the concept of private equity and is also an effective introduction to his firm. Private equity may be a straightforward idea, but in reality it is an incredibly complex undertaking, which is why the asset class remains a non-core allocation within institutional portfolios.

-

Asset Class Reports

Asset Class ReportsPrivate debt: Managers take back control

Steady demand for private credit puts lenders in a strong position to negotiate beneficial terms, but discipline in lending remains crucial

-

Interviews

InterviewsAP4: A pension fund investing 40 years into the future

Niklas Ekvall (pictured), CEO of Fjärde AP-fonden (AP4), one of the Swedish buffer funds, talks to Carlo Svaluto Moreolo about building a robust and sustainable long-term portfolio