All Country Reports – Page 5

-

Country Report

Country ReportItaly: Pension investors raise their sustainability game

Pension funds and other institutions are making greater use of engagement and voting as they pursue their ESG goals

-

Country Report

Country ReportItaly: Pension funds face SFDR test

A significant number of pension funds have classified their portfolios under the EU’s flagship sustainability disclosure regulation

-

Country Report

Country ReportItaly: Government plans to draw in capital for domestic investment

The right-wing government is moving forward with plans to create a €1bn fund, amid criticism and lukewarm investor support

-

Country Report

Country ReportCountry report – Pensions in Nordic Region (June 2023)

Reputational issues are front of mind for the board of Alecta, Sweden’s largest pension fund, as it continues to digest the fallout from its ill-starred investments in Silicon Valley Bank and two other US financial institutions that collapsed in March this year.

-

Country Report

Country ReportNordic region: Alecta faces an uphill battle

The regulator is investigating the pension fund, and it is clear the scheme will have to make some effort to restore its reputation after huge losses on US bank investments

-

Country Report

Country ReportNordic region: Swedish pensions at a crossroads

The country’s Pension Agency has come up with three proposals: review, reform or remain the same

-

Country Report

Country ReportNordic region: NBIM looks to diversity to improve decision making

The manager of Norway’s sovereign wealth fund kickstarted its diversity and inclusion programme in 2020, and has since focused on embracing new measures to become more diverse

-

Country Report

Country ReportNordic region: Knut Kjaer on the future Norway's sovereign wealth

NBIM’s founding CEO Knut Kjær talks about Norway’s sovereign wealth fund adapting to changing geopolitical and economic realities

-

Country Report

Country ReportNordic region: Finnish solvency rules raise questions about risk

Many argue that the current rules are too restrictive, hampering investment returns

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2023)

UK pensions are at a crucial juncture. The UK Parliament’s inquiry into the LDI crisis of September 2022 shed some light on its causes, but the debate on the role of LDI is alive and well. Meanwhile, regulators including The Pensions Regulator and the Financial Conduct Authority have advised pension schemes on how to make LDI strategies more resilient to shocks.

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over

-

Country Report

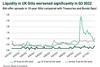

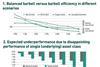

Country ReportUK: to barbell or not to barbell?

In the new world of lower LDI leverage, trustees must choose between maintaining hedging or diversification

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Country Report

Country ReportUK: Beware the unintended consequences of the DB funding code

Laura McLaren highlights the unintended consequences of TPR’s proposed code, and what can be done to mitigate the risks

-

![Ewan McCulloch (7)[33]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/6/1/3/138613_ewanmcculloch733_634858_crop.jpg) Country Report

Country ReportUK: Is it too soon to reform pension pools?

In his March 2023 Budget, UK chancellor Jeremy Hunt challenged the Local Government Pension Schemes (LGPS) in England and Wales to “move further and faster on consolidating assets”, proposing that LGPS funds transfer all listed assets into their pools by March 2025.

-

Country Report

Country ReportUK: The case for pooling

Successful pooled schemes such as Border to Coast should be open to other clients because they are good at what they do

-

Country Report

Country ReportUK: DC investment won't be a panacea for tech and science

The UK government’s March Budget contained plans to boost investment in high-growth industries such as digital, life sciences and advanced manufacturing, so they can start, scale up and remain in the UK.

-

Country Report

Country ReportUK: Schemes must prioritise members

Pension funds are encouraged to invest in UK illiquids, but it cannot come at any cost

-

Country Report

UK: One way for DC schemes to access private markets

There is much debate about mark-to-model valuation methodologies and whether a material economic downturn will cause these to catch up with public market price falls, but the history books will show that portfolios with allocations to private markets were more robust than those with none in 2022 – the worst year on record for traditional balanced portfolios.

-

Country Report

Country ReportCountry Report – Pensions in the Netherlands (April 2023)

The Netherlands is in the final legislative stages of what will probably be the largest and most complex workplace pension system change ever in the world. Yet as it edges towards the parliamentary finishing line, recent political events could yet knock the process off course.