Latest analysis – Page 11

-

Analysis

AnalysisAnalysis: Pension funds need flexible mind to invest in circular economy

Pension funds must remove barriers and relax financial and accounting requirements to allow for circular investments, according to investors and investee companies

-

Analysis

AnalysisAnalysis: German states realign €30bn pension fund assets to stricter ESG standards

Four German states have recently revised their sustainable investment strategies, sticking to stricter ESG rules

-

Features

FeaturesCareer development: Reaching to the next generation in pensions

Pensions can be seen as a dry industry, but an array of initiatives is seeking to support younger professionals

-

Analysis

AnalysisAnalysis: How to navigate cyber security crisis management

More than 400 pension funds using Capita’s services should check whether their scheme’s data could be affected

-

Features

FeaturesGreenwashing: Teasing out the intentional from the accidental

Greenwashing is increasingly under the spotlight as investors and rulemakers try to figure out whether the chief concern is untruthfulness or the unintentional misleading of clients with environmental claims

-

Analysis

AnalysisAnalysis: Opinion split over SFDR updates

Rulemakers have maintained that the function of the regulation is to mitigate greenwashing by promoting transparency, not by setting standards

-

Features

FeaturesUkraine: The mother of all impact investments

Institutional investors can play a crucial role in rebuilding Ukraine in a post-war future

-

Analysis

AnalysisAnalysis: Synergies and obstacles of a potential UBS/Credit Suisse asset management merger

The outcome of the merger is positive for UBS which ‘is buying the asset manager of Credit Suisse for nothing’, says Ray Soudah

-

Opinion Pieces

Opinion PiecesMight Ukraine’s distressed assets one day look attractive to pension funds?

Russia’s invasion of Ukraine in February 2022 has tested Europe’s political and economic resolve. But where Vladimir Putin attempted to sow discord, he instead has failed to divide the West.

-

Opinion Pieces

Opinion PiecesHow to define natural capital and greenwashing

Last month, I wrote about recent challenges that have arisen from the terminology of sustainable finance – the legal and political consequences of the sometimes careless ways that terms like ESG, ethics, risks and impact have been interchanged depending on audience and public mood.

-

Opinion Pieces

Opinion PiecesGermany's gamble with sweeping pension reforms

This is without a doubt an interesting time for pension reforms in Germany, given the inevitable associated risks of failure.

-

Features

FeaturesTCFD reporting for pension funds in the UK: a progress report

Some 18 months from the introduction of mandatory reporting of climate data by large UK pension funds, evidence shows that the policy has not brought about greater orientation towards green investments

-

Opinion Pieces

Opinion PiecesTime to rethink defined contribution pensions design

This year is shaping up to be the worst for investment returns since before the great financial crisis, according to IPE’s latest performance analysis of the leading European pension funds.

-

Features

FeaturesEuropean pension dashboard in the starting blocks

The European Tracking Service for pensions has been years in the making but is now set for a rollout, to be completed by 2027

-

Features

FeaturesUK LDI woes raise wider European questions

Turmoil in UK Gilt markets has forced continental European pension industries to review their risk management strategies

-

Analysis

AnalysisAnalysis: Outperformance brings factor investing back in favour

64% of investors say confidence in factor investing has improved over the past year, according to Invesco

-

Features

FeaturesInternational Sustainability Accounting Standards Board: An insider view

Technical director Ravi Abeywardana highlights the challenges faced by the newly minted International Sustainability Standards Board and its staff

-

Analysis

AnalysisAnalysis: Goodbye, LDI? Too early to say

The sudden and unprecedented rise in Gilt yields, caused by the UK government massive fiscal stimulus announcement, tested the risk management strategies of UK DB schemes

-

Analysis

AnalysisAnalysis: How Swiss pension funds tackle governance in asset management

‘A professional investment process requires a separation of powers between the investment decision, implementation and monitoring of the investment activity,’ says PPCmetrics

-

Features

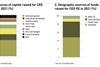

FeaturesCEE private equity: in search of capital

War in Ukraine is just one factor deterring investment in private equity and growth capital in Central and Eastern Europe