ESG Special Reports – Page 12

-

Special Report

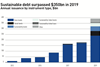

Special ReportPrivate and green: Non-listed sustainable debt

The market for non-listed debt with green or sustainability features is growing fast

-

Special Report

Special ReportTransition bonds: Questions of transition

The market for sustainable investments is growing exponentially

-

Special Report

Special ReportGreen bond issuance: Denmark's split offering

The Danish government is keen to employ tradeable green certificates, which are designed to broaden the appeal of environmental debt, in its initial green bond issuance

-

Special Report

Special ReportClimate benchmarks: Brown to green

Brown to green - Index providers are making the first steps towards adoption of the new EU climate benchmarks

-

Special Report

Special ReportESG: A new dawn

How can private equity firms avoid suspicions of greenwashing as the industry embraces ESG?

-

Special Report

ESG: The long quest for comparable data

A growing band of institutional investors and other financial actors is seeking better and more comparable inputs to financials statements in areas like carbon emissions

-

Special Report

Special ReportRisk metrics jigsaw

Moves to promote useful climate risk disclosure among companies are hampered by highly variable risk metrics and a lack of cohesive standards

-

Special Report

Special ReportBrydon Review: Call for deeper, wider audits

UK review reveals stakeholders would like more information on company prospects and risks

-

Special Report

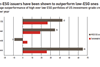

Special ReportCredit Ratings: Good credit, bad behaviour?

Rating agencies and asset managers are starting to integrate ESG in bond portfolios

-

-

Special Report

Special ReportArtificial Intelligence: Solving the riddle with AI

Artificial intelligence is making it possible to glean better ESG information about companies

-

Special Report

Special ReportSDI Asset Owner Platform: ESG investing gets a platform lift

Two Dutch pension providers have launched a global platform to help asset owners invest in line with the UN’s Sustainable Development Goals

-

Special Report

Special ReportInvestment Process: A recipe for confusion

The shift to ESG has inadvertently led to divergence of opinion over the best metrics to use

-

Special Report

Special ReportRobeco Active Ownership: ‘Engagement’s not a one-off’

Carola van Lamoen, the head of active ownership at Robeco, talks to Liam Kennedy

-

Special Report

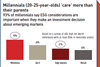

Special ReportESG Adoption: Big advances on the ESG front

A custodian’s view on how technology and a generational shift are powering the growth of ESG investment among European pension funds

-

Special Report

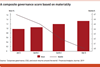

Special ReportMateriality: A new framework for ESG

A new materiality concept focuses on seeking investment value where the interests of shareholders and other stakeholders intersect

-

Special Report

Research: Europe has turned a corner

Asset managers must cater to the trend to deeper ESG investing to remain competitive Key points ESG investing in Europe has developed over more than three decades There are four broad categories of ESG investment – exclusion, integration, stewardship and impact Integration is the most widespread approach ...

-

Special Report

Special ReportIceland: From strategy to practice

Several factors are pushing Icelandic pension funds towards responsible investment

-

Special Report

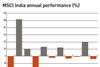

Special ReportIndia: Still early days

The growing adoption and importance of ESG criteria among Indian firms could have implications for companies such as rice producers

-

Special Report

Mining the ESG vein

ESG used to be an optional extra in the mining industry but governments are starting to mandate minimum standards through legislation