Investment – Page 10

-

Features

IPE Quest Expectations Indicator - September 2022

The war in Ukraine is characterised by a build-up for the battle for Kherson. The result of that campaign is likely to have great political influence on both sides. Neither is capable of a surprise win, but time works against Russia. In the US, Trump’s legal troubles are serious and mounting, but any Republican successor may be even more destructive. The EU is running against time to prepare for winter. Both optimists and pessimists are over-estimating the ability of technicians to predict the future. Russia has lost the EU as a primary customer for its oil and gas. It must make up for higher distribution costs by offering significant discounts.

-

Features

FeaturesA flawed EU crypto regulatory framework

The EU will soon have a specific regulatory framework for crypto currencies and markets. Under proposals soon to be adopted, only crypto coins authorised in the EU will be allowed to be offered to investors. But crypto assets and exchanges will have a very light supervisory regime, much less than what is in place for financial instruments and exchanges. This raises the question about the rationale for distinct rules. This question is even more acute in the context of the big decline in the crypto markets over the past weeks.

-

Features

FeaturesAhead of the curve: solving the Russian share ban

Index investors inherently choose to follow the market through exchange-traded and index funds, but the recent prohibition on trading Russian stocks and their removal from global benchmarks has created something of a conundrum.

-

Interviews

InterviewsStrategically speaking interview: Jose Minaya, Nuveen

Asset managers with a yield-hungry pension investor as a parent nowadays usually have to diversify their footprint into private markets, often by acquisitions in one form or another.

-

Features

Features‘Painful’ private equity fees are hard to avoid

The Netherlands’ €551bn ($576bn) civil service scheme ABP paid a record €2.8bn in performance fees to private equity managers in 2021, prompting the fund’s president Harmen van Wijnen to announce an external investigation to assess ABP’s rising asset management costs. The €277.5bn healthcare scheme PFZW paid €1.26bn in performance fees to private equity last year, accounting for two thirds of total asset management costs.

-

Features

FeaturesAsset owners need to find the best stock pickers

For pension funds, an asset manager search is a high-stakes exercise. Get it wrong and the scheme could be saddled with an underperforming manager for an extended period of time, dragging down returns and potentially impacting member outcomes.

-

Features

FeaturesCustodians will be key as investors move into digital assets

Digital assets may seem to be the latest investment trend, but institutions are taking their time in embracing them. Moving interest to the next level will require not only greater regulation but also a solid network of custodians to provide the required security and protection.

-

Features

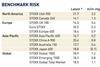

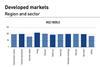

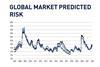

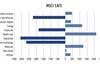

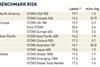

FeaturesQontigo Riskwatch - July/August 2022

* Data as of 31 May 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Interviews

InterviewsStrategically speaking interview: Edwin Conway, BlackRock Alternative Investors

Many asset owners focus on the return streams available from private markets investments and the diversification effect of private equity, debt or any of the other flavours available in this sector of the market.

-

Features

FeaturesAhead of the curve: tie executive pay to climate targets

AllianzGI and Cevian Capital take very different approaches to how we manage equity portfolios, but we are both long-term and active owners of companies. Following a series of conversations about how to best implement ESG criteria in our portfolios, we have found a common perspective.

-

Features

FeaturesEmissions reporting: taking stock of indirect emissions in Scope 3

Disclosure proposals by the US Securities and Exchange Commission (SEC) in March could guide the regulatory searchlight beyond companies’ direct and indirect C02 emissions (Scope 1 and 2) and towards upstream and downstream (Scope 3) emissions.

-

Features

FeaturesYen’s swift dive surprises market

For several decades, the Japanese yen has not been in the limelight too often. However, earlier this year it became headline news as the currency began to depreciate rapidly against the US dollar. Although investors were not overly surprised that the yen would weaken, the speed of its decline was certainly startling. Over the course of about 15 months, between the start of 2021 to early April 2022, the yen has lost about 25% of its value against the dollar, with nearly half the move occurring in that final month.

-

Features

FeaturesUK venture: new kids on the block

Google the venture firm 2150 and you won’t find an investment strategy but a manifesto.

-

Features

FeaturesQontigo Riskwatch - June 2022

* Data as of 29 April 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesInvestors sceptical on Tokyo equity market reforms

In April, the Tokyo Stock Exchange (TSE) implemented its biggest overhaul in over 60 years in an attempt to attract foreign investors. However, many industry experts see the move as largely symbolic and believe more needs to be done to create a roster of high-quality companies with strong corporate governance practices.

-

Interviews

InterviewsStrategically speaking interview: Sandro Pierri, BNP Paribas Asset Management

Like many of his counterparts at large asset management firms, Sandro Pierri is mindful of how global trends are influencing his clients and the best ways for his firm to address them.

-

Features

FeaturesAhead of the curve: China treads a careful path

Since the Tiananmen Square protests in 1989 the Chinese Communist Party has not put a foot wrong domestically. It has pursued economic growth alongside social cohesion, entrenching its prime objective of staying in power.

-

Features

FeaturesQontigo Riskwatch - May 2022

* Data as of 31 March 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants