Investment – Page 9

-

Features

FeaturesThe rising influence of target-date funds on capital markets

One of the fastest growing markets in recent years is the US retirement market. Since 1995, the investment volume has increased six-fold, so that by the end of 2021, the market stood for almost $40trn (€40.1trn) AUM.

-

Features

Features17Capital’s Pierre-Antoine de Selancy: Navigating NAV lending

Pierre-Antoine de Selancy has just left a meeting with his company’s new majority shareholder, Oaktree, and is running a little late. His days are busy. De Selancy is founder and managing partner of 17Capital, a London-based boutique specialised in providing NAV finance to private equity managers.

-

Features

FeaturesUK sovereign debt in turbulent waters as challenges remain

The buttoned-up Gilts market has never seen or done anything like it. Trusty stalwart of liability matching for defined benefit (DB) pension schemes, the blue-chip security has already poleaxed a British chancellor of the exchequer just a month in office, and has effectively done the same to prime minister Liz Truss.

-

Features

FeaturesAhead of the curve: Beefing up guardrails as risks rise in private credit

For US and European private credit firms, storm clouds are gathering.The recent rate hikes by the Federal Reserve, European Central Bank (ECB) and the Bank of England (BoE)have numbed activity in the leveraged loan and high-yield spaces.

-

Features

FeaturesQontigo Riskwatch - November 2022

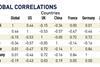

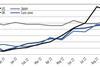

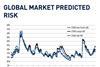

*Data as of 30 September 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

IPE Quest Expectations Indicator - November 2022

In general, political risk remained the same, except in the UK. The Russian offensive against Ukrainian civil infrastructure is useless. If it should succeed, Russia has no means to exploit it militarily. Ukraine is set to recover Kherson. In the EU, France is trying to cope with a vicious strike that blocks petrol deliveries, but its side effect is a push towards hybrid and non-petrol cars. Japan is worried over implicit North Korean nuclear threats. In the UK political risk has increased fast with a crisis caused by government tax plans that has sapped trust on several levels. The data indicate that analysts believe that the wave of interest rate increases is near (if not over) its top and that bonds are now becoming more attractive than equities for the first time in many years.

-

Features

FeaturesLGIM’s Michelle Scrimgeour: ambitions for growth

Michelle Scrimgeour and her executive team set out their strategic growth priorities in November 2020, a little more than a year after she had taken over as CEO of Legal & General Investment Management (LGIM). They agreed to grow the business by focusing on existing strengths: to modernise, diversify and to internationalise.

-

Features

FeaturesPension funds continue their focus on ESG social issues

Before the year is over, European policymakers are expected to announce their decision to shelve plans for a social taxonomy.

-

Features

FeaturesMarket overview: German institutional investors manage uncertainty

At mid-year 2022, the volume of Spezialfonds – the German vehicle for professional investors – administered on Universal Investment’s platform was €498bn, a rise of around 5% year on year. On a six-month basis, however, and compared with the end of the booming stock year 2021, asset volumes were down around 3%.

-

Features

FeaturesAhead of the curve: Clearing up the ‘scaling’ confusion in carbon intensity

Today, a company’s carbon intensity is typically measured in one of two ways – scaling by revenue, or by EVIC (enterprise value including cash). The choice an investor makes can lead to differences in portfolio characteristics.

-

Features

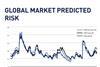

FeaturesQontigo Riskwatch - October 2022

*Data as of 31 August 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator: monthly commentary

Political risk has decreased. An attack in the north-east of Ukraine took the Russian army by surprise but did not cause collateral damage in Russia. Russians’ resistance to the war is mounting but far from a critical level. It looks like the EU will survive the winter without major energy disruption and caps on energy prices are falling into place.

-

Interviews

InterviewsStrategically speaking interview: Italian, global and poised for growth

In asset management, three years can be a short or a long time, depending on many factors, including market conditions. To some asset management executives, the second half of the 2010s perhaps felt like an endless slog, due to the intense competition for market share and outperformance within the seemingly never-ending bull market. The first two years of the new decade have certainly elapsed more quickly, thanks to the historical significance of the events that have occurred.

-

Features

FeaturesEuro peripheral spreads

Just over a decade ago, Mario Draghi, then President of the ECB, gave a speech in which he uttered the famous words: “.…the European Central Bank [ECB] is ready to do whatever it takes to preserve the euro”, a phrase often credited with hauling Europe out of the depths of its sovereign debt crisis.

-

Features

FeaturesCommodities show their value

The few pension schemes with an investment in commodities benefitted from this allocation in recent months. Prices in this asset class rose as the pandemic and war in Ukraine pushed up the cost of fossil fuels and re-ignited inflation while both equity and bond markets faltered.

-

Features

FeaturesAhead of the curve: Are defensive strategies delivering?

Introducing ‘defensiveness’ to equity portfolios can take many forms. At the most explicit end of the spectrum, we can consider dialling down market exposure using derivative-based equity overlays – whether these are static protection programmes or more complex dynamically managed strategies which could even include some implicit volatility trading. At the more implicit end, promising reduced ‘downside capture’, we find a wide array of defensive long-only equity strategies.

-

Features

FeaturesQontigo Riskwatch - September 2022

*Data as of 29 July 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-