IPE's Germany Coverage – Page 3

-

Opinion Pieces

Opinion PiecesGerman pension reforms in limbo after coalition government collapse

The collapse of Germany’s three-way ‘traffic light’ coalition in November opens questions about the fate of the pension reforms it had drafted over the past couple of years. The government, led by Olaf Scholz, started in 2021 with a mission to reinforce the capital-funded component of the pension system.

-

Features

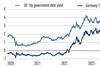

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

News

NewsBVI warns of new law for venture capital, infra investments being politicised

The new rules create a legal framework that removes obstacles for investment in infrastructure and renewable energy projects

-

News

NewsEx-Siemens CEO views pensions as main block of ‘Agenda 2030’ for Germany’s recovery

‘Pensions must be financed upwards through private wealth accumulation among young people,’ says Joe Kaeser

-

News

NewsAdepp, ABV call for improving EU framework for private markets investments

Associations highlight need for a common, stable framework on risk calculation and reporting systems

-

News

Germany’s plan to turn KENFO as central asset manager could stand despite crisis

Former traffic-light governing coalition intended to set up a central federal asset manager as part of the draft law reforming the first pillar pension system

-

News

NewsPublica hires new chief investment officer from VBL

Sandro Doudin will take over as head of asset management and member of the Publica’s management board on 1 July 2025

-

Analysis

AnalysisIPE DACH Briefing: Germany’s pensions industry looks to new government for reforms

Plus: Transition to DC schemes in Germany; ASIP and Publica in Switzerland warn of consequences of higher lump-sum withdrawals

-

News

NewsGerman insurance association backs auto-enrolment for occupational pensions

GDV is in favour of adjusting the retirement age to increasing life expectancy

-

News

NewsVBL picks Nordea to invest €1.25bn in Paris-aligned equities

The fund is pursuing an ambitious CO2 reduction target as it aims to cut greenhouse gas emissions by 7% per year

-

News

NewsGerman bank Berenberg, Lurse join forces to set up OCIO provider

The two firms are merging their respective company pension solutions to create specialised OCIO provider for asset allocation of company pension schemes

-

News

NewsGerman pensions industry pins hope on next cabinet for second pillar reform

Germany’s occupational pension industry has been let down by the sudden halt of the second pillar pension system reform process, triggered by a political crisis, as it pins its hope on the next government to build on the groundwork laid out so far. Speaking at the Handelsblatt occupational forum in ...

-

News

NewsHapag-Lloyd, Evonik switch to defined contribution plans

Existing occupational pension contracts for senior people and captains of Hapag-Lloyd will remain in place, despite the DC switch

-

News

NewsGerman SMEs sceptical of DC plans without guarantees

The majority of SMEs is in favour of guaranteed benefits that are primarily intended to support low earners, part-time workers or young professionals

-

News

NewsGerman liberal party axes first pillar pension reform package

Labour minister Hubertus Heil says his party SPD ‘will fight’ to find a majority in Parliament to approve the reform package before elections on 23 February 2025

-

News

NewsAba looks beyond snap elections for comprehensive pensions reform

Germany’s three reform packages for public, occupational and private pensions are currently at different stages of the legislative process

-

News

NewsTransition to DC plans by German firms almost complete, says WTW

Survey shows that 97% of firms in Germany now offer a defined contribution option

-

Analysis

AnalysisCollapse of German government coalition turns back clock on pension reforms

Finance minister and head of the FDP Christian Lindner, whose party pushed for an equity fund for first pillar pensions, was sacked today

-

Analysis

AnalysisGerman finance minister’s pension plans continue to test coalition

Chancellor Olaf Scholz rushes to hold talks today after FDP finance minister Christian Lindner puts forward new economic reform ideas