IPE's EU Coverage – Page 7

-

News

NewsSkandia stows $100m in Dutch-backed sustainability blended-finance fund

Swedish pensions firm praises ‘innovative’ structure of SDG Loan Fund for easing flow of institutional money to developing countries

-

Analysis

AnalysisConcerns grow over fate of EU sustainability due diligence law

One of the biggest battlegrounds for the CSDDD is proving to be the inclusion of the finance sector

-

News

NewsEIOPA chair pushes for action on pension dashboard, auto-enrolment, PEPP

Petra Hielkema reveals frustration that European Commission has not taken further action on a pensions dashboard

-

Special Report

Special ReportEuropean pension fund class actions take off on a steep learning curve

What positive developments can we report relating to class actions in UK and European pension funds? What regulatory challenges still need to be overcome to facilitate (for instance, simplify) the environment for class action by UK and European institutions? Where are the key gaps in knowledge among pension funds?

-

Special Report

Special ReportClass actions: Is Europe catching up with the US?

Europe’s institutional investors are latching on to the rewards of joining class actions against investee companies. Many of these are securities lawsuits, pursued when a publicly listed company has not properly disclosed or has misrepresented significant information, affecting the share price when the truth emerges. But so far, the vast majority of these have been in the US. In 2022, nearly $4.9bn (€4.6bn) was recovered in the US courts, according to Institutional Shareholder Services. So, what about class actions in Europe? “The US has had a class action system for over a hundred years that can be adopted for almost every cause of action, whereas the UK has only had class actions since 2015 and it is only available for competition cases,” says Harry McGowan, partner in the securities litigation department at law firm Stewarts.

-

Special Report

Special ReportShareholder class actions in Europe: the benefits and risks of participating

Litigation outside the United States, and in particular in Europe, has been on the rise since the US Supreme Court’s landmark 2010 decision in Morrison v. National Australia Bank. In Morrison, the US Supreme Court ruled that “foreign” (non-US) investors cannot bring federal securities lawsuits in US courts to recover investment losses relating to foreign-issued securities traded on foreign exchanges (known as “F-cubed” claims). As former Justice Antonin Scalia explained, the concern was to prevent the US from becoming “the Shangri-La” of class-action litigation for lawyers representing those allegedly cheated in foreign securities markets. Although federal courts have since struggled to apply Morrison’s effect test consistently, it is clear, more than 10 years later, that the decision has had its intended effect.

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

News

NewsVarma picks Ortec for performance management software

Finnish pensions heavyweight says Ortec product gives better understanding of sources of value

-

Special Report

Special ReportPlenty left for EU sustainable finance policy to tackle

European policymakers have gone full throttle on sustainable finance over the past five years. Do they have the wherewithal to finish the job?

-

Special Report

Special ReportWhat should EU investors do if the Republicans win the White House?

Sustainability-minded investors should wake up to the challenge of right-wing populism and its threat to climate policy

-

News

NewsSwedes see refund from dropped Russian, East European premium pension funds

Pensions agency announces further SEK247m refund from Barings, East Capital and Nordea funds – deregistered after Ukraine invasion – to first-pillar pension savers

-

News

NewsIreland’s new €100bn SWF is no ‘rainy-day fund’, says McGrath

Budget plans include two sovereign wealth funds, with largest designed to cover known future costs

-

News

NewsESMA study fails to find a systematic greenium for sustainable bonds

EU supervisory body researchers say willingness to accept lower returns for ESG is limited

-

Features

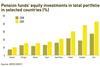

FeaturesResearch: Pension funds stabilise EU financial markets in good times and bad

A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017

-

Special Report

Special ReportActive ETFs power ahead

While active managers are out of favour, their strategies embedded in an exchange traded fund package are gaining traction. In fact, they are outpacing passive ETFs as investors look for liquidity and robust risk-adjusted returns with a relatively low price tag.

-

News

NewsAkademikerPension sees positive return impact after shedding last oil/gas major

Danish occupational pension fund divests Italy’s Eni, excluding last large upstream oil and gas company in its portfolio

-

News

NewsAP2 helps German think tank develop portfolio tool to assess deforestation risk

In work funded by Californian philanthropists, Swedish national pensions buffer fund says publicly-accessible workflow will be tested on AP2’s listed equities

-

Opinion Pieces

Opinion PiecesEurope escaped the Great Retirement Boom but watch out for the crunch

Continental Europe appears to have largely escaped the trend known in the US as the ‘Great Retirement Boom’, where an economically comfortable cohort of 50 to 64-year-olds has retreated from work in the post-COVID period.

-

Asset Class Reports

Asset Class ReportsRethinking net-zero equities benchmarks

The EU developed rules for climate benchmarks in 2019. After a surge in uptake, investor sentiment is already cooling

-

News

NewsIlmarinen posts 3.7% H1 return; CEO urges solvency framework reshape

Listed equities form backbone of investment gain while property returns hover around zero