IPE's EU Coverage – Page 10

-

Opinion Pieces

Opinion PiecesESG Viewpoint: Article 9 of SFDR – the new green lodestar?

Regrettably, the EU’s Taxonomy for Sustainable Activities has gone from proposing “real change” to “may be imperfect”. These are the polite words of EU financial services commissioner Mairead McGuinness. Less politely, Greta Thunberg judged that the taxonomy simply “takes greenwashing to a completely new level [since t]he people in power do not even pretend to care any more. They just label fossil gas as green and nuclear waste as pollution controllable over the next 100,000 years.”

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Pension funds and the EU’s sustainability agenda

The European Commission’s Sustainable Finance Strategy, published in summer 2021, sets out how it will support the EU Green Deal and Europe’s transition to carbon neutrality by 2050.

-

Features

FeaturesEuro peripheral spreads

Just over a decade ago, Mario Draghi, then President of the ECB, gave a speech in which he uttered the famous words: “.…the European Central Bank [ECB] is ready to do whatever it takes to preserve the euro”, a phrase often credited with hauling Europe out of the depths of its sovereign debt crisis.

-

News

Schroders identifies persistence in private equity returns [updated]

Research by Schroders Capital finds that past performance could be more instructive for some parts of the private equity market than others

-

News

Norway’s SWF joins ESMA in call for pragmatism in EU corporate sustainability rules

NBIM advocates fewer disclosure metrics and more focus on key data likely to be valuable to users

-

Features

FeaturesA flawed EU crypto regulatory framework

The EU will soon have a specific regulatory framework for crypto currencies and markets. Under proposals soon to be adopted, only crypto coins authorised in the EU will be allowed to be offered to investors. But crypto assets and exchanges will have a very light supervisory regime, much less than what is in place for financial instruments and exchanges. This raises the question about the rationale for distinct rules. This question is even more acute in the context of the big decline in the crypto markets over the past weeks.

-

News

NewsIIGCC calls for ‘ambitious, speedy’ resolutions on key EU climate files

CEO writes to ministers, leaders ahead of EU Council energy and environment meetings

-

News

NewsInvestor groups welcome deal being struck on EU CSRD, next stop standards

Corporate Sustainability Reporting Directive ‘essential for coherent implementation’ of EU sustainable finance framework

-

News

NewsDiversity, fiduciary ‘impact’ duty and more on EIOPA IORP II review task list

European Commission’s call for advice finally lands in EIOPA’s inbox

-

News

NewsPensionsEurope backs ‘high added value’ withholding tax action at EU level

Umbrella association responds to European Commission consultation

-

News

Commission grants final central clearing exemption for pension funds

Pension schemes will be expected to clear via EU CCPs, says Mairead McGuinness

-

Special Report

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.

-

Special Report

Special ReportTop 120 European Institutional Managers 2022

Total non-group assets managed for all types of European institutional clients – pension funds, insurance companies, corporates, charities and foundations – for the leading 120 managers in this business segment. Total assets are €14.4trn (2021: €12.2trn)

-

-

Special Report

Special ReportOutlook: Future of hydrocarbons

The OECD remains critically dependent on Russian oil and gas – and finding alternative sources will be very hard

-

Special Report

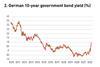

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

News

NewsEU securities watchdog delivers anti-greenwashing supervisory briefing

Briefing described as ‘to-do list’ for national supervisors on how best to deal with greenwashing in asset management

-

News

NewsDutch query EC due diligence proposal pension fund scope, fit

Pensioenfederatie calls for clarification and amendment of Commission’s proposed corporate sustainability due diligence directive proposal

-

News

NewsEFRAG flags SFDR PAI links in draft corporate reporting standards

Draft EU corporate sustainability reporting standards out for consultation

-

Opinion Pieces

Opinion PiecesRobust central clearing is critical for millions of Europeans

Derivatives like interest rate swaps are now a central component of risk management best practice. According to a 2018 paper by ISDA and PensionsEurope, the percentage of hedged pension liabilities in Denmark, the Netherlands and the UK ranges from 40-60% of total liabilities.