IPE's EU Coverage – Page 8

-

Features

FeaturesDiscerning investor sentiment: this year’s proxy season

Every annual general meeting (AGM) season has traditionally brought with it a few symbolic moments – events that serve as broader indicators of the market’s mood when it comes to environmental and social issues.

-

News

NewsEIOPA says national supervisors need more data on liquidity risks

European pension funds, insurers holding up well despite higher stability risks, says latest risk report from EU pension and insurance watchdog

-

News

NewsIlmarinen anchors new Amundi climate-focused Europe ETF with €580m

Finnish pensions major edges closer to having all its passive equities tracking MSCI’s Climate Action indices

-

Special Report

Special ReportSpecial Report – Outlook: Europe and the world

Inflation may be losing momentum, thanks to vigorous central bank action, but with a recession on the horizon, it is hard to tell whether the next few months and years will see markets turn around and risk assets begin to perform again. For the time being, CIOs argue for selectivity in stock selection and generally agree that bonds have resumed their diversification role. The main article in our Outlook report features the views of influential CIOs and strategists on asset allocation for the next few years.

-

Special Report

Special ReportOutlook – Europe and the world: US overtakes Europe in clean-energy production

Incentives package for US-based clean energy investments is seen by some as a threat to Europe’s industrial competitiveness

-

Special Report

Special ReportOutlook – Europe and the world: UK launches its own approach to green investment

The focus is on financial regulation rather than economic policy to drive decarbonisation

-

Special Report

Special ReportOutlook – Europe and the world: Ageing Europe puts strain on growth

The continent is the oldest in the world, with fast shrinking populations and lower fertility rates

-

Interviews

InterviewsLCH: The other side of the mirror

Isabelle Girolami undoubtedly has a strong background in financial services, having worked for a range of very different institutions in very different roles. She was COO at the fixed income division of BNP Paribas, before going on to a similar role at Bear Stearns, the bank that failed early in 2008 and which was subsumed into JP Morgan. Prior to her current role at LCH she was global head of markets at Crédit Agricole.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Pensions and the EU's plans on social protection

Elections for the European Parliament will be held in spring 2024, after which a new European Commission will be formed. Early preparation to collect new ideas is ongoing. The Commission’s high-level group on the future of social protection and of the welfare state published a report in February, taking a wide-angle look at social protection, including pensions.

-

News

Pensioenfederatie wants sustainability due diligence directive to include investors

The federation is rallying support for investors to engage with investee companies on human rights violations and environmental adverse impacts

-

Special Report

Special ReportBriefing – Regulation

In Frankfurt, EIOPA has responded to the European Commission’s call for technical advice in its stocktake on IORP II, the European framework for occupational pensions. EIOPA proposes widening the scope of IORP II in a pivot away from cross-border pensions and towards sustainability. A consultation process is open until 25 May.

-

Special Report

Special ReportRegulation: EIOPA takes stock of IORP II

Sustainability requirements in focus as EIOPA admits cross-border ‘failure’

-

Special Report

Special ReportRegulation: EC continues sustainable investment regulation drive

The state of play for EU sustainable finance regulation

-

Special Report

Special ReportRegulation: IPE’s guide to pensions regulation in six key European countries

IPE’s guide to pensions regulation in six key European countries. Gail Moss reports

-

News

NewsDanish pension funds laud EU red-tape cutting and urge EIOPA to follow suit

Crucial that business reporting provides value, says IPD

-

Asset Class Reports

Private debt: European markets try to power ahead

Private debt in Europe is still feeling the impact of the war in Ukraine and the surge in inflation, but there are reasons for optimism

-

Opinion Pieces

The cost of gender equality in pensions

The gender pension gap continues to be a significant issue in the European labour market, where women are at a disadvantage compared to men in terms of retirement income.

-

Features

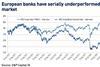

FeaturesFear and loathing in European banks

Any CEO would recognise there is a problem when investors do not want to put their money to work with you. That is the situation that European banks find themselves in. The MSCI Europe bank index has considerably underperformed its MSCI Europe parent over the last 10 years.

-

Features

FeaturesPensionsEurope: Not all doom and gloom for 2022

After the bumper investment returns of 2021 – the best that many pension funds had ever experienced – last year’s results were disappointing.

-

Asset Class Reports

Asset Class ReportsFixed income: Transition plans and green bonds

Should companies publish climate plans before they can issue green bonds?