Previous Top 1000 Pension Funds – Page 3

-

Special Report

Special ReportTop 1000 Pension Funds 2022: Pension assets increase reflects 2021’s markets

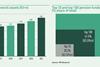

The assets of the leading 1000 European pension funds increased by well over €600bn in our latest survey – a large portion of which can be attributed to strong investment returns on the back of a sustained post-COVID rebound over the course of 2021. Developed market equities returned over 30% in euro terms in 2021, compared with losses of around 4.7% in global aggregate bonds.

-

Special Report

Top 1000 Pension Funds 2022: Data

OECD Pension Funds in Figures, 2022 (data for France from 2021 edition); *Data on asset allocation in these figures include both direct investment in equities, bills and bonds, cash and deposits and indirect investment through CIS when the look-through of CIS investments is ...

-

Special Report

Austria: Debate on pension reforms continues

Promises to review Austria’s pension system made over recent years have not materialised, resulting in a renewed push for action by the pension industry

-

Special Report

Belgium: Limited agreement on pension changes reached

A minimum monthly first-pillar pension will apply from 2024 but there has been little effort to boost supplementary schemes

-

Special Report

Denmark: Commission heralds comprehensive approach

Expert body tackles complexity, incentives, tax and indexation

-

Special Report

Finland: New laws passed ahead of unified pensions blueprint

Working group proposals for merging pension systems yet to be published

-

Special Report

France: New government revives pension reform

Under Emmanuel Macron’s second presidential term, the French government hopes to achieve an overhaul of the first-pillar pension system

-

Special Report

Special ReportGermany: Unlocking innovation and improving risk assessment

The German government is encouraging institutional investors to invest in venture capital funds to help support start-up companies

-

Special Report

Special ReportIceland: International Monetary Fund warns on system risk

Despite its top-ranking pension system, there has been slow progress on increasing diversification abroad and in infrastructure

-

Special Report

Ireland: IORP implementation prompts consolidation

Ireland’s pensions trade body warns that many smaller schemes will be unable to meet the requirements of IORP II, accelerating the move to master trusts

-

Special Report

Italy: Debate on reform continues ahead of snap election

Plans announced to lower the retirement age and raise public benefits, but there has been little discussion of a greater role for second-pillar pensions

-

Special Report

Special ReportNetherlands: Rising funding ratios with a bitter side taste

Dutch funding ratios have continued to rise, but are being overshadowed by inflation concerns and enormous investment losses

-

Special Report

Special ReportNorway: Steps towards a new pension settlement

Increasing the retirement age will help put Norway’s pension system on a more sustainable footing, but improving benefits will mean extra costs

-

Special Report

Special ReportPortugal: Sustainability efforts need to be redoubled

Portugal recognises that past pension reforms mitigated the fiscal effects of an ageing population, but more effort is needed over the coming years

-

Special Report

Special ReportSpain: Second-pillar reforms broaden coverage

Amendments to existing laws and new ones extend access to second-pillar occupational pension funds to more workers

-

Special Report

Special ReportSweden: Premium pension revamp takes shape

Following the appointment of a board, the new Fund Selection Agency is filling senior management slots and the AP7 default fund is undergoing a strategy revamp

-

Special Report

Special ReportSwitzerland: First-pillar reforms put to the public

A referendum this autumn will decide the fate of reform to the first pillar, and parliament will debate the reform of the second pillar

-

Special Report

Special ReportUK: Going green amid a regulatory overhaul

The industry is concerned about a focus on derisking as the regulator’s new funding code takes shape this autumn

-

Special Report

Special ReportTop 1000 Pension Funds 2021: Powering on ahead

With a gross headline increase in pension assets of over €800bn – or 9.8% – Europe’s pension fund asset pools can be said to have powered through the COVID-19 crisis, riding the market highs to bank a solid recovery.

-