All Briefing articles – Page 8

-

Features

Briefing: The cliff-hanger of European banks

It has been a bad decade for European financials, with share prices still a fraction of their pre-crisis highs

-

Features

Briefing: Sri Lanka after the bombings

The tragic Easter Sunday bombings have devastated tourism, a key plank of the economy

-

-

Features

FeaturesChina: To be or not to be

Investors are divided on whether to classify Chinese equities as a distinct asset class

-

Features

FeaturesBecoming a mortgage lender

More pension funds are eyeing residential mortgages as an asset class

-

Features

FeaturesBriefing: Emerging markets fail to catch up

Emerging markets have failed to increase their share of global investible market capitalisation since 2007

-

Features

FeaturesBriefing: Looking to active managers

Active management versus passive index tracking remains one of the most hotly contested questions in the world of investment management.

-

Features

FeaturesChina tech: Playing BATs versus FAANGs

Chinese tech firms offer exposure to rapidly expanding domestic markets

-

Features

FeaturesUS economy: Overpricing recession risk

Financial markets have suffered a nasty bout of indigestion since October. The interplay of sentiment and volatility induced widespread pessimism, with added concern that market tantrums could subsequently bleed into the real economy

-

Features

FeaturesCLO supply outstrips demand

Do reports of a growing wariness over collateralised loan obligations (CLOs) mean that the good times are over for the investment vehicle?

-

Features

FeaturesBriefing: Collateral challenges

Rising interest rates put collateral management strategies to the test

-

Features

FeaturesBriefing: Trade war, a primer

Protectionism is becoming more widespread despite the benefits of free trade being understood for more than two centuries

-

Features

FeaturesBriefing: MiFID II: a year on

The new rules are having a dramatic effect on the world of investment research

-

Features

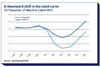

What next for US Treasuries?

A consensus on the direction of 10-year US Treasury rates is not obvious, because the answer reverts to a further question: whose consensus? Strategists, economists and other informed professionals have a particular view. The market itself, however, expresses a more diffuse and different opinion.

-

Features

Macro Matters: Currency returns to the fore

Global tension means exchange rates will again become a key mover of investor decisions

-

Features

German Longevity: Are the tables turning?

The rate of increase in life expectancy in Germany appears to be slowing down

-

Features

Benchmarking: Redefining investment classes

A major GICS index methodology change seeks to reflect underlying market economics

-

Features

Turkey: Rethinking auto-enrolment

Despite generous state incentives in the Turkish auto-enrolment system, opt-out rates are high

-

Features

Liquid Alternatives: The long and the short of it

The long/short liquid alternatives universe is more hetreogenous than some realise

-

Features

UK: Shifts in longevity

Whether or not to insure liabilities via a buyout or buy-in has long been a decision which most defined-benefit pension funds need to consider. Buyout deals have become integral to the pension fund landscape.