All Country Report articles – Page 8

-

Country Report

Country ReportFrance: Third-pillar pensions and sustainability take centre stage

Clémence Droin, senior engagement manager at Indefi, talks to IPE about the two main areas of focus for the French institutional investment community lack of a regulatory push from pension reforms

-

Country Report

Country ReportFrance: The biodiversity reporting enigma

France’s financial institutions must report on biodiversity impacts but face a lack of corporate data push from pension reforms

-

Country Report

Country ReportCountry Report – Pensions in France (October) 2022

The French pension system is in good health with a first-pillar pay-as-you-go system in surplus. But long-term forecasts are cause for concern, showing that the French state will have to raise expenditure on pensions from the current 13% to nearly 15% of GDP to maintain the system.

-

Country Report

Country ReportNetherlands: Implications of the new pension system

The move towards a new Dutch pension system will have significant effects on swap curves and asset allocation

-

Country Report

Country ReportNetherlands: Dutch pension funds make early switch to DC

There are various HR and corporate motives for switching to defined contribution arrangements before the new pension system comes into play in the Netherlands

-

Country Report

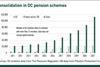

Country ReportNetherlands: Pension transition drives consolidation

Pension schemes are turning to mergers as one way to cope with the rising costs of complying with greater regulation

-

Country Report

Country ReportItaly: Struggles of the pension sector

Italian industry-wide pension funds fail to attract new members, with potentially serious long-term consequences

-

Country Report

Country ReportItaly: The greening of the pension industry

Italian pension funds are developing their approaches to sustainable investing, with increasing focus on impact and engagement

-

Country Report

Country ReportItaly: Pension funds adapt to a new regime

Inflation, higher interest rates and geopolitical tensions are leading Italian pension funds to recalibrate their investment strategies

-

Country Report

Country ReportCountry Report – Pensions in Italy (July/August 2022)

Italy’s pension industry continues to develop, albeit at a slow pace. Italian pension funds are adapting their strategies to the volatile and uncertain market regime, by purchasing inflation-linked assets and by taking advantage of potentially higher yields on domestic government bonds. However, as our lead article highlights, they are generally staying true to their long-term diversification strategies, which consist of gradually allocating to alternatives including private equity, private debt and infrastructure. Some have bought shares in the Bank of Italy, a private equity-like investment.

-

Country Report

Country ReportNordic Region: Sweden prepares for a pensions reboot

The Swedish Fund Selection Agency is set to take over the reins of the SEK 2trn premium pension system following a series of scandals

-

Country Report

Country ReportNordic Region: Dorrit Vanglo exit interview

For LD’s outgoing CEO, being mindful of working with other people’s money is key – as is a sense of humour

-

Country Report

Country ReportNordic Region: KLP fosters healthy start-up culture

The Norwegian pension fund’s accelerator programme teams up with CoFounder to help early-stage businesses with investment, advice and management

-

Country Report

Country ReportNordic Region: Pension funds look to asset managers for climate action

Asset managers have been criticised for slow actioning of investors’ ESG policies

-

Country Report

Country ReportCountry Report – Pensions in the Nordic Region (June 2022)

We open our June Nordic Region report with a stark question: are asset managers living up to asset-owners expectations on ESG, in particular when it comes to climate change reporting?

-

Country Report

Country ReportUK: Pension dashboards make slow progress

DWP timeline is met with optimism but complex UK system throws up problems

-

Country Report

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

Country Report

Country ReportUK: Collective defined contribution pensions move up a gear

The first collective defined contribution pension scheme is set to launch after years of stop-start progress. But obstacles remain

-

Country Report

Country ReportUK: Interview with Sally Bridgeland

Sally Bridgeland, chair of Local Pensions Partnership Investments, discusses the institution’s net-zero carbon emission and cost-reduction strategies

-

Country Report

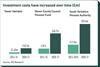

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise