ESG

In-depth reporting on ESG investing for our pension fund and asset management readers from IPE’s award-winning journalists

Latest news

Allianz GI amends ESG fund investment policies for ESMA compliance

Allianz GI, AXA IM and DWS reveal their plans to comply with ESMA rules

CCLA proposes next steps for asset manager net-zero initiative

Charity investor says asset managers will need flexibility, and clarity from asset owners about their goals

Allspring launches two climate transition funds seeded by Aon

The funds apply a climate transition approach to help clients achieve their net-zero ambition while delivering on their financial objectives

CEPB leads investor engagement for peace in Goma

The investor engagement initiative follows the capture of the Democratic Republic of Congo city of Goma by Rwandan-backed M23 rebels

#13 Leaders in Investment podcast: Conversation with Morten Nilsson and Wyn Francis – CEO, CIO of Brightwell, UK

Morten Nilsson and Wyn Francis, Brightwell’s CEO and CIO, discuss the management of the BT Pension Scheme – the UK’s largest single employer pension scheme – including their investment strategies, ESG goals, relationships and adapting to industry changes.

IPE ESG Briefing: BlackRock exits NZAM

Plus: NZAM suspends operations; AP7 reviews BlackRock’s decision

Sustainable finance is braced for its toughest year yet

‘If ever we needed asset owners to be the drivers of responsible investment, it’s in 2025,’ says ShareAction’s Simon Rawson

UKSIF chief sees hope for further traction of UK anti-greenwashing measures

James Alexander, CEO of UKSIF, expects more asset managers to get authorisation for sustainable investment labels in 2025

Sustainable finance recalibrates following Trump's re-election

It really does boggle the mind. In the US the likes of BlackRock, which in January quit the Net Zero Asset Managers initiative (NZAM), have been accused by the left, liberals and activists of not being forceful enough when it comes to supporting the fight against climate change, and by the right for going too far.

Viewpoint: Investors and boards should collaborate strategically on sustainability

Collaborative support for legislative reforms, taxation frameworks, and public incentives is vital to create a level playing field for long-term value creation, says Gillian Secrett

Investors cautiously optimistic as US exits from Paris Agreement

Despite Trump’s decision, there are still attractive opportunities for those willing to invest with a long-term view, industry claims

Prospects for 2025: Pension investors identify risk scenarios

High equity valuations and a possible return of inflation, caused by geopolitical tensions and US policy, have European pension funds worried

- Previous

- Next

The business case for nature: why companies need to act

As an ex-physicist, I feel confident in proclaiming that economics is not a science but, rather, the study of human behaviour on a mass scale. Why does that matter?

Sweden's buffer fund AP4 considers doubling allocation to defensive equities

An overhaul of buffer fund’s dynamic normal portfolio is already under way in a bid to adapt to greater global uncertainty

HypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

What happened at COP16?

Major deals were postponed at a UN summit as investors and the private sector busied themselves on the sidelines

LeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

#10 Leaders in Investment podcast: Conversation with Professor Dirk Schoenmaker, Investment Committee Chair, PFZW

In Episode #10 of IPE’s Leaders in Investment podcast series, IPE Editorial Director Liam Kennedy interviews Professor Dirk Schoenmaker, Investment Committee Chair at Dutch pension fund PFZW

Have factor investing strategies had their day?

Factors have inspired indices, spin-offs and a variety of investment strategies but it has become hard to argue that they will offer investors a persistent future premium

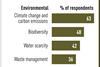

Thematic investing set to morph into impact investing

In the second article on a new survey, Vincent Mortier, Monica Defend and Amin Rajan argue that greater granularity in ESG investing is set to boost impact investing