All IPE articles in January/February 2025 (Magazine)

View all stories from this issue.

-

Opinion Pieces

Opinion PiecesA gloomy outlook for German pension reforms

The collapse of Berlin’s ‘traffic-light’ coalition of Social Democrats (SPD), Greens and the liberal FDP late last year brought to an abrupt end a pension reform process that was proceeding slowly but surely.

-

Country Report

Country ReportIreland gears up to future-proof pensions

Getting the country’s new auto-enrolment system up and running is a major priority to meet the needs of an expanding workforce

-

Opinion Pieces

Opinion PiecesSustainable finance recalibrates following Trump's re-election

It really does boggle the mind. In the US the likes of BlackRock, which in January quit the Net Zero Asset Managers initiative (NZAM), have been accused by the left, liberals and activists of not being forceful enough when it comes to supporting the fight against climate change, and by the right for going too far.

-

Special Report

Special ReportFiduciary management: Race for UK mandates intensifies

UK pension schemes with complex and diverse needs are turning to fiduciary management in growing numbers. Who will be the winners in this increasingly competitive sector?

-

Opinion Pieces

Opinion PiecesUK fiduciary management industry needs to expand

The idea that too much choice limits freedom, known as the paradox of choice, is a powerful one. But the opposite is true as well, especially when it comes to the UK fiduciary management industry.

-

Asset Class Reports

Asset Class ReportsTrade and economy weigh on European credit

Despite trade worries and a challenging economic outlook, appetite for European credit remains robust, bolstered by refinancing activity and a supportive ECB stance

-

Features

Central & Eastern Europe pension plans still not integral to employment benefits

CEE has no tradition of employer pension responsibility Most countries lack collectively bargained agreements New systems are being rolled out but many are still in the adoption phase

-

Features

FeaturesCross-border investment barriers: issues for institutional investors

Protectionist trade policies are back in vogue, fuelled by the rise of China’s economy and, more recently, by the escalation of geopolitical tensions.

-

Interviews

InterviewsEuropean pension funds on investing in their home market: a delicate balance

Pension funds in Europe have been reducing their allocation to European assets, especially listed ones. While valuations may be attractive, there is little else to convince them to raise their investments in their home market

-

Analysis

AnalysisAsian emerging markets on the rise

Investors are taking note of investment opportunities in Asia in a variety of different ways, as new research shows

-

Interviews

InterviewsECP Asset Management: An Australian approach to concentrated equity portfolios

The 2020s will likely be remembered as a period of high stock market concentration, similar to the decade of ‘nifty fifty’ stocks, which propelled the US market in the years before the 1973 crash.

-

Asset Class Reports

Asset Class ReportsEuropean equities: Bargains or bear traps amid global headwinds?

Despite record valuation gaps with the US, investors remain cautious about European equities. Political turmoil, geopolitical risks, and fears of tariffs under Trump’s presidency cast a shadow, while fund managers pivot toward stock-specific opportunities

-

Asset Class Reports

Asset Class ReportsEurope investment outlook: Search for opportunities amid the gloom

We asked fixed-income managers for their views on Europe’s outlook as Germany and France grapple with structural challenges and political uncertainty.

-

Opinion Pieces

Opinion PiecesAI poised to revolutionise pension systems

The global pension landscape is at a crossroads. With over $55.7trn (€54trn) in assets under management across 22 major economies, pensions are integral to global capital markets.

-

Analysis

AnalysisConcern as UK steams ahead with local pension reforms

Consultation responses highlight what could be an over-ambitious timetable to reform Britain’s giant Local Government Pension Scheme

-

Opinion Pieces

Opinion PiecesA bulwark against pensions populism

Increased longevity and declining birthrates are societal trends that can be experienced in insidious ways. It’s harder to get a doctor’s appointment or a diagnostic healthcare test. Schools are downsizing and closing.

-

Analysis

AnalysisThe business case for nature: why companies need to act

As an ex-physicist, I feel confident in proclaiming that economics is not a science but, rather, the study of human behaviour on a mass scale. Why does that matter?

-

Special Report

Achmea IM and BlackRock emerge as winners in the Dutch fiduciary management market

Last autumn, Shell’s €26bn Dutch defined benefit (DB) pension fund announced it would swap Samco, the oil giant’s in-house asset manager, for BlackRock as its fiduciary manager.

-

Country Report

Country ReportIreland country report 2025: Post-election – is auto-enrolment coming?

After successive delays, the country’s new auto-enrolment retirement system is finally set to get off the ground this year

-

Research

ResearchIPE institutional market survey: Managers of Irish institutional assets 2025

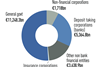

IPE’s latest survey of Ireland’s institutional asset management market covers €294.9bn in total assets managed by 23 domestic and global managers for Irish institutional clients, with €108.9bn invested by pension funds.