All Private Equity articles

-

Analysis

AnalysisAsian emerging markets on the rise

Investors are taking note of investment opportunities in Asia in a variety of different ways, as new research shows

-

News

NewsGuidance published for buying carbon credits in private markets

Survey shows just four private equity houses offset emissions from their investment portfolios

-

News

NewsCassa Geometri plans €150m private equity investment

The scheme will pursue buy-out and growth capital strategies, investing in primary or secondary markets

-

News

NewsVBL to boost private equity and private debt investments

New allocations will be financed through new premiums and a mix of public equities, gold and cash, says CIO Michael Leinwand

-

News

NewsPE exits ‘bode well’ for DC pensions market and private market investment

UK government aims to increase pension fund investment in UK private markets

-

News

NewsPensionDanmark to ramp up equities after 17% stocks gain in 2024

Danish pension fund to increase the equity proportion particularly for younger scheme members, and postpone risk reduction starting point by five years to age 50

-

News

NewsP+ taken to task by Danish FSA over private equity risk measurement

Financial watchdog criticises pension fund for failing to document appropriateness of data source behind model to estimate PE risk premium

-

News

NewsATP disappointed as Better Energy restructures

Citing ‘perfect storm of negative market conditions’, Danish renewable-energy firm enters restructuring to rebuild capital base and stabilise the business

-

News

NewsATP admits DKK2.3bn investment in Northvolt now worth almost zero

Danish statutory pensions giant’s CEO declines to rule out investing more in stricken battery Swedish firm

-

News

NewsCandriam enters European private equity market in strategic partnership

Partnership positions Andera to expand its client base and further develop its private capital strategies across Europe and globally

-

News

NewsPension funds seek private equity managers with ability to add long-term value

Emphasis is shifting from quantity to quality in private markets as investors seek GPs with superior skills and the ability to add value above and beyond financial engineering

-

News

NewsMonte dei Paschi scheme seeks asset managers for DB sub-fund, private equity

The pension fund is looking for an asset manager to invest €70-80m in private equity and another for €80m to run its DB sub-fund

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

Interviews

InterviewsLeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

-

Analysis

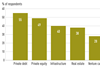

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Country Report

Country ReportDanish pension funds split over venture capital opportunities

PensionDanmark is backing early-stage venture capital investments but its peers are shying away from VC

-

News

NewsPrivate equity, VC ESG reporting template gets update for early-stage

Update ‘aligns with the requirements of major European LPs’, according to KfW Capital

-

News

NewsNordic pension funds protect interests as Northvolt seeks bankruptcy protection

CEO exit ‘not entirely unusual’ given Swedish battery firm’s new phase, says Folksam

-

News

NewsFidelity International to integrate private markets assets into default investment strategy

The circa 15% allocation by Fidelity’s FutureWise fund will be the first into its recently approved Long-Term Asset Fund

-

News

NewsATP’s returns leap in Q3 despite private equity write-downs

Danish pensions giant posts 9.7% gain on investment portfolio in January-September despite massive private equity wipeout