ESG Special Reports – Page 5

-

Special Report

Special ReportESG: Debate - Double or single materiality?

Two leading academics discuss the investment benefits of single versus double materiality

-

Special Report

Special ReportESG: Will Scope 3 lead to a tech exodus in public markets?

Could the roll out of Scope 3 reporting bring ESG funds’ love affair with tech to an abrupt end?

-

Special Report

Special ReportESG: Central banks nudge lenders to produce climate data

Lenders face a variety of challenges when measuring the environmental impact of their balance-sheet exposure

-

Special Report

Special ReportESG: Interview - Julian Poulter of The Inevitable Policy Response on ‘disorderly transition’

It is hard to stay positive about the climate transition when listening to Julian Poulter. The head of investor relations at Inevitable Policy Response (IPR), the climate policy forecast run by the Principles for Responsible Investment, has been working on climate change since 2009, when he was CEO of the Asset Owners Disclosure Project. But while many green-finance veterans are giddy about the snowballing interest in net zero, Poulter is feeling less bullish.

-

Special Report

Special ReportESG: Leading viewpoint - COP27 is the key moment to address the net-zero trilemma

World leaders gather in Egypt at a decisive time

-

Special Report

Special ReportESG: Leading viewpoint - write off ESG at your peril

ESG’s current travails are a mid-life crisis out of which something better and fitter will emerge

-

Special Report

Special ReportESG: Leading viewpoint - why a carbon footprint does not measure what you think it does

The concept of ecological footprinting turns 30

-

Special Report

Special ReportESG: Leading viewpoint - rethinking sovereign bonds

Sovereign debt markets are not fit for purpose

-

Special Report

Special ReportAsia investment: GIC enhances sustainability focus

A sustainability office now complements a sustainable investment fund that was launched in 2020

-

Special Report

Special ReportAsia investment: Japan’s GPIF assesses new strategy

World’s largest pension fund aims improve its allocation to ESG indices following a positive five-year track record

-

Special Report

Special ReportHow green are green derivatives?

On 6 April 2022 the European Commission announced that derivatives, including futures, swaps and many other instruments routinely used by ETF providers, cannot be classified as ESG or sustainable or green in investment fund reports.

-

Special Report

Special ReportTo Paris and beyond: capturing energy transition and climate investment opportunities with ETFs

The climate emergency is arguably the greatest challenge of our lifetimes. We must use every tool at our disposal – including financial – to stand any chance of success. Thankfully, investors are ever more aware that incorporating climate in their portfolios can help them manage asset-specific risk, access opportunities from the shift to clean energy and achieve something meaningful with their money. And they are ever more aware they can do it in flexible, cost-effective ways.

-

Special Report

Special ReportAdding to the biodiversity protection toolbox

Biodiversity is intricately linked with economic growth and development. Since the industrial revolution ecosystems have been under constant threat with the advent of large towns, cities and industrial complexes. The rate of deterioration has accelerated over time and we are now destroying natural capital at an unprecedented rate, which will have long-term consequences for economies, societies and the planet.

-

Special Report

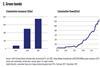

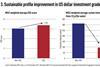

Special ReportWhy investors use sustainable fixed income ETFs

Sustainable fixed income investing is growing at a rapid rate as investors increasingly seek to address climate risks, meet new regulations, and adapt to new investment preferences. The majority of investors who are choosing indexed exposures to build their sustainable portfolios are currently following SRI indices, with 93% of AUM in sustainable fixed income UCITS ETFs tracking such indices.

-

Special Report

RFQ platforms and the institutional ETF trading revolution

What do ETFs, RFQ and ESG all have in common? Aside from being some of the most popular acronyms in the history of financial services, the three-letter abbreviations for exchange-traded funds (ETF), electronic request-for-quote (RFQ) trading, and environmental, social and governance (ESG) driven investing, have all come together at the centre of a revolution in asset management.

-

Special Report

Legal and regulatory developments: EU plays catch-up

While the European framework for establishing ETFs has not changed substantially in recent times, developments within the legislative bodies of the EU present a number of current and potential hurdles for ETFs in the short to medium term. This article will look at each legal development in turn. It is also important to note that the COVID-19 pandemic has highlighted a number of areas that need to be strengthened.

-

Special Report

Special ReportNorway: Steps towards a new pension settlement

Increasing the retirement age will help put Norway’s pension system on a more sustainable footing, but improving benefits will mean extra costs

-

Special Report

Special ReportPortugal: Sustainability efforts need to be redoubled

Portugal recognises that past pension reforms mitigated the fiscal effects of an ageing population, but more effort is needed over the coming years

-

Special Report

Special ReportSpecial Report – Outlook

It’s hardly news that inflation is high on asset owners’ minds right now. We asked eight seasoned asset allocators, CIOs and strategists the same question: how do you rate the chances of stagflation? And what to do about it?

-

Special Report

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.