All Equities articles

-

News

NewsDeepSeek’s arrival increases risk for passive investors

But it provides upside for companies that use AI applications, or are keen to start doing so, according to investment experts

-

Interviews

InterviewsEuropean pension funds on investing in their home market: a delicate balance

Pension funds in Europe have been reducing their allocation to European assets, especially listed ones. While valuations may be attractive, there is little else to convince them to raise their investments in their home market

-

Analysis

AnalysisAsian emerging markets on the rise

Investors are taking note of investment opportunities in Asia in a variety of different ways, as new research shows

-

Interviews

InterviewsECP Asset Management: An Australian approach to concentrated equity portfolios

The 2020s will likely be remembered as a period of high stock market concentration, similar to the decade of ‘nifty fifty’ stocks, which propelled the US market in the years before the 1973 crash.

-

Asset Class Reports

Asset Class ReportsEuropean equities: Bargains or bear traps amid global headwinds?

Despite record valuation gaps with the US, investors remain cautious about European equities. Political turmoil, geopolitical risks, and fears of tariffs under Trump’s presidency cast a shadow, while fund managers pivot toward stock-specific opportunities

-

Features

FeaturesIPE Quest Expectations Indicator - January 2025

The erosion in trust in the US is promoted by its refusal to participate in a proposed trigger force in Ukraine. In response, European defence expenses are rising, in particular in Poland, the Baltics and Scandinavia.

-

Research

ResearchIPE institutional market survey: European equities managers 2025

The IPE European Equities Survey 2025 captures €1.71trn in assets managed in European equities by 55 global and European asset managers. Of this, €615bn is invested on behalf of European institutions.

-

News

NewsPrecious metals, equities propel Publica’s returns to 5.9%

Precious metals were among the best-performing asset classes in Publica’s portfolio last year, returning 33%

-

News

NewsFinnish pensions reform seen widening equity allocations by 10 points

Ilmarinen and Varma say increased volatility is price worth paying for the higher return potential that newly agreed investment reforms allow

-

News

NewsSwedish funds lobby bemoans late changes, as FTN extends deadline again

Swedish Fund Selection Agency pushes deadline for active global equity tender back for second time, citing ‘ambiguities’ in the RFP

-

News

NewsAkademiker overhauls equity strategy behind new market-rate product

Danish labour-market pension scheme dials risk levels both up and down within range of AlfaPension profiles

-

News

NewsGerman liberal party pushes programme for pension investments in equities

FDP is campaigning for a “real statutory equity pension” based on the Swedish premium pension model

-

News

NewsPensionDanmark to ramp up equities after 17% stocks gain in 2024

Danish pension fund to increase the equity proportion particularly for younger scheme members, and postpone risk reduction starting point by five years to age 50

-

News

NewsNBIM proposes cutting smaller EM stocks from SWF’s benchmark

Proposed change would excise thousands of Chinese stocks from GPFG’s €1.7trn portfolio

-

News

NewsPFA’s climate product beats standard pension with 19.6% return

Parts of the green sector hit by declining investment appetite in 2024, says CIO

-

News

NewsDutch doctors’ fund focuses on Europe in new equity portfolio

The scheme’s new concentrated portfolio only includes 65 companies

-

News

NewsFondenel launches new equity investment option

Under the new option, the pension fund will pursue a strategy with a strong exposure to equities

-

Features

FeaturesBriefing: The challenge of investing in Europe’s energy transition

The way the European economy powers itself is undergoing a fundamental shift, driven by market forces and policymakers. But while the direction of travel is clear, the path to a different energy mix is tortuous and the shift may be much slower than required to meet Europe’s target to be net zero by 2050.

-

Features

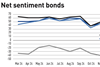

FeaturesAsset allocation: hard to pick short-term winners

IPE’s latest manager expectations survey finds high net sentiment across most main asset classes as allocators weigh the Trump trade

-

News

NewsNorway SWF urges CII to go further combatting ‘stealth dual-class structures’

NBIM gives views to Council of Institutional Investors on proposed policy changes on unequal voting structures