Private Debt

In-depth reporting on investing in Private Debt for our pension fund and asset management readers from IPE’s award-winning journalists.

-

Analysis

AnalysisAsian emerging markets on the rise

Investors are taking note of investment opportunities in Asia in a variety of different ways, as new research shows

-

News

NewsAPG and Rabobank invest €800m in new impact loans

The investment has been made through Colesco Capital, a new Rabobank-owned investment platform with a focus on sustainable corporate loans

-

News

NewsVBL to boost private equity and private debt investments

New allocations will be financed through new premiums and a mix of public equities, gold and cash, says CIO Michael Leinwand

-

News

NewsATP disappointed as Better Energy restructures

Citing ‘perfect storm of negative market conditions’, Danish renewable-energy firm enters restructuring to rebuild capital base and stabilise the business

-

News

NewsPension funds seek private equity managers with ability to add long-term value

Emphasis is shifting from quantity to quality in private markets as investors seek GPs with superior skills and the ability to add value above and beyond financial engineering

-

News

NewsIPE Conference: Private debt said to make overall economy more resilient

From a system risk point of view, private debt funds are much less risky than bank lending, Tilburg University professor argues

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

Analysis

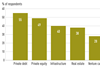

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

News

NewsAviva Investors launches third UK LTAF with addition of private debt fund

New fund gets £750m cash injection from Aviva’s Future Focus default pensions solution

-

News

NewsHSBC Asset Management targets venture debt offering

Former Silicon Valley chief credit officer has been tasked to bring new product to market

-

News

NewsItaly’s pension fund for notaries ponders first move into private debt

Cassa Nazionale del Notariato currently has 3-4% invested in private equity and infrastructure funds

-

Country Report

Country ReportLower interest rates see Swiss pension funds adjust asset allocations

Lower rates are nudging Swiss pension funds to rethink their approach to fixed income and private markets

-

Asset Class Reports

Asset Class ReportsEmerging markets private credit steps into the breach

Institutional investors are increasingly providing the funding that emerging market companies cannot get from banks

-

Opinion Pieces

Opinion PiecesAustralian regulators take a deep dive into growing private markets sector

The recent brisk battle to buy an Australian data centre platform, AirTrunk, pushed the price to more than A$24bn (€14.5bn) – double what was anticipated just a few months ago.

-

News

NewsMandate roundup: Compenswiss tenders direct lending mandates

Plus: APK issues $300m EM debt brief; Italian journalists scheme award €100m corporate bond mandate

-

News

NewsAllianzGI’s impact private credit strategy reaches €560m at first close

Investors include Allianz, APG Asset Management, the European Investment Fund (EIF), and La France Mutualiste

-

News

NewsAXA IM Alts snaps up European private assets firm CAPZA

Acquisition sees AXA IM Alts enter traditional private equity sector and expand its global debt platform into mid-market direct lending

-

News

NewsAviva adds venture capital capability to rebranded private markets business

Latest move comes as Aviva Investors continues to expand its private markets offering to meet evolving demands of investors

-

Opinion Pieces

Opinion PiecesUS court scraps SEC private equity transparency rule

The US appeals court’s decision, last June, to throw out a Securities and Exchange Commission (SEC) rule intended to give investors more transparency into private funds has sparked a heated debate.

-

Interviews

InterviewsKPN Pensioenfonds: Active investors by conviction

Caspar Vlaar and Jaap van Dam of KPN Pensioenfonds talk to Tjibbe Hoekstra about the Dutch fund’s belief in active investing, its venture into private markets and its impact strategy