Latest analysis – Page 8

-

Analysis

AnalysisTPR to be lobbied after new fiduciary duty, climate report

it is crucial that TPR adds the report’s key messages to its official guidelines, says Maria Nazarova-Doyle

-

Opinion Pieces

Opinion PiecesViewpoint: Why profitability may be the greatest quality

Research shows that a company’s current profitability is a powerful predictor of its future cash flows

-

Analysis

AnalysisNBIM needs much longer-term strategy and better communication, academic finds

Nicolai Tangen praised for SWF’s transparency in releasing the internal report on its organisational culture

-

Opinion Pieces

Opinion PiecesViewpoint: Investor climate scenarios need to be probability-aware

Riccardo Rebonato, of EDHEC-Risk Climate Impact Institute, argues that climate scenarios need to come with probabilities if they are to be useful for investors

-

News

News2024 to be the biggest year for UK pension de-risking

WTW expects the pension risk transfer market to reach £80bn in 2024

-

Analysis

AnalysisMansion House reforms: UK government should embrace long-term thinking to boost the economy

Other countries have been far better than the UK at creating long-term strategies that have been maintained way beyond the five-year or shorter electoral timescales on which UK politicians focus

-

Analysis

AnalysisEU capital markets face an uncertain future

The success of the European Union depends on developing its capital markets, but achieving integration faces political, cultural and technical challenges

-

Analysis

AnalysisThematic investing set to morph into impact investing

In the second article on a new survey, Vincent Mortier, Monica Defend and Amin Rajan argue that greater granularity in ESG investing is set to boost impact investing

-

Analysis

AnalysisMansion House Compact: spotlight on Smart Pension

Smart Pension joined the Mansion House Compact in July 2023 as one of the first signatories, committing to allocating at least 5% of its default funds to unlisted equities

-

News

NewsWhat does Thames Water’s valuation dip mean for UK pension funds?

Earlier this month USS cut the value of its investment in Thames Water from £956m to £364.4m

-

News

NewsWhat the EU’s new due diligence law means for investors

CS3D will affect investors in several ways even though they will not, at least initially, face due diligence requirements on financial assets

-

Analysis

AnalysisMansion House Compact: spotlight on Mercer

Mercer joined the Mansion House Compact in July 2023 as one of the first signatories, committing to allocating at least 5% of its default funds to unlisted equities

-

Analysis

AnalysisDutch pension funds keep increasing interest rate hedges

Funds increasingly want to protect their funding ratios in the run-up to the pension transition and see an opportunity to lock in rates at current high levels

-

Analysis

AnalysisLabour market evolution: the macro trend that investors cannot ignore

Macroeconomic factors can overwhelm micro ones for investors. The impact of COVID is a good example. But the short-term impact of COVID on labour markets can mask structural trends in the evolution of labour markets that have much more profound long-term impacts, according to a paper by PGIM

-

Analysis

AnalysisHigh stakes as pension funds take on Tesla

A group of Nordic pension funds is tentatively standing up to Elon Musk’s electric car giant, in reaction to a labour dispute at Tesla in Sweden. The strike at the end of October by 130 Tesla workers affiliated with IF Metall led to a wave of sympathy strikes which spread to Norway, Denmark and Finland.

-

Analysis

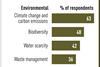

AnalysisSustainable finance: outlook and trends for 2024

Transition finance is expected to be one significant theme in 2024 as net-zero regulations come into force

-

Analysis

AnalysisNet zero marks the second era of climate finance

Monica Defend, Vincent Mortier and Amin Rajan discuss progress and holdups on the global journey to net zero

-

Book Review

Book ReviewBook review: The Financial Markets of Ancient Egypt – Risk and Return

“If men could learn from history, what lessons it might teach us. But passion and party blind our eyes.”

-

Analysis

AnalysisGerman companies rethink occupational pension plans

German corporates reorganise their pension plans in a bid to win over talent, fight skilled workers shortage, and exploit opportunities for a flexible transition to retirement

-

Analysis

AnalysisFCA did not consider UK pension funds concerns over listing regime

The Authority set out proposals to make UK listing regime ‘more accessible, effective, and competitive’