Latest analysis – Page 2

-

Analysis

AnalysisIPE Nordic Briefing: Norway’s SWF calls for lift of general freeze on Russian assets

Plus: Clarity for Icelandic pension funds on legal situation around provisions for changed life expectancy; Sweden’s financial watchdog on increased pension transfers

-

Analysis

AnalysisIPE ESG Briefing: Environment Agency Pension Fund develops new RI policy

Plus: Aviva is fined for breaching SFDR; Swiss and Dutch schemes are more resilient to disruptive climate policies

-

Analysis

AnalysisGerman occupational pension schemes gear up for 2025

Pensionsfonds continue to be one of the most preferred vehicles for companies to outsource direct pension promises

-

News

NewsReputational disaster or ‘badge of honour’? Fund managers split over Aviva’s SFDR fine

Asset manager is first to face enforcement under the rules, but peers are divided on what it means

-

Analysis

AnalysisIPE UK Briefing: Consolidating LGPS assets and DC funds into 'megafunds'

Plus: British Growth Partnership; Innovation in BPA market

-

Analysis

AnalysisEurope must prepare for a China after Xi Jinping

Whatever the big issues of the 21st century, whether climate change, the environment, restoring economies post-COVID, fighting poverty or ending the war in Ukraine, they are much easier to resolve if countries work together.

-

Analysis

AnalysisIf UK defined contribution is ‘broken’, could collective DC be the answer?

Collective DC is emerging in the UK but time will tell whether employers will embrace it

-

Analysis

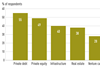

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Opinion Pieces

Opinion PiecesViewpoint: Stewardship deserves a return to first principles

As the UK’s Financial Reporting Council consults on updates to the country’s Stewardship Code, Hans-Christoph Hirt, trustee director of the Hermes Group Pension Scheme, says it’s time for the investment industry to have an open conversation about the objectives of stewardship

-

Analysis

AnalysisIPE Netherlands Briefing: First three funds get go-ahead for DC switch

Plus: BP pension fund is considering a buyout to a Dutch insurer for its Belgium-based DB accruals

-

News

NewsWhat the Mansion House speech means for green finance in the UK

Government reinstated the Bank of England’s mandate to support sustainable finance and updated remit letters of key regulators to refer to the need for investment in the green transition

-

Analysis

AnalysisItalian institutional investors confronted with hard reality of net-zero transition

Panellists at Salone.SRI in Milan this week agreed that journey towards net zero will progress despite challenges

-

Analysis

AnalysisIPE DACH Briefing: Germany’s pensions industry looks to new government for reforms

Plus: Transition to DC schemes in Germany; ASIP and Publica in Switzerland warn of consequences of higher lump-sum withdrawals

-

News

NewsConsolidating DC schemes into megafunds could lead to unintended consequences

UK government proposes consolidation of DC schemes into £25bn megafunds

-

Analysis

AnalysisHow German companies deploy AI for occupational pensions

The positive aspect of using AI in occupational pensions is that it helps to transfer information, says Vodafone Pension Trust

-

Opinion Pieces

Opinion PiecesViewpoint: Let’s talk about responsible investment due diligence

Eilidh Wagstaff, senior specialist for multi-asset in the Principles for Responsible Investment’s (PRI) investor guidance team, takes stock of what’s working and what isn’t in responsible investment due diligence

-

Analysis

AnalysisIPE ESG Briefing: COP29 dubbed ‘Finance COP’

Plus: Church Commissioners’ message on policies supporting 1.5°C pathway; NZAOA discloses portfolio decarbonisation of 80 asset owners

-

Analysis

AnalysisIPE Nordic Briefing: Iceland preps review of national pensions sytem

Plus: Iceland schemes reject banking rules; Sweden’s watchdog warns of risks for consumers on pension transfers

-

Analysis

AnalysisUK’s productive agenda overlooks life insurers holding £310bn of pension assets

UK life insurers could potentially invest up to £100-£200bn in productive investments over the next 10 years

-